In 2018 Enbridge Inc. (ENB) completed its plan to acquire all outstanding shares of Enbridge Income Fund Holdings Inc. (ENF). Under the arrangement, ENF shareholders received:

- 0.7350 shares of ENB, and

- a cash payment of $0.45

for each share of ENF held on November 15, 2018. An ENF shareholder also received an accrued ENF dividend of $0.1883 per share payable on November 15, 2018 for ENF shareholders of record on October 31, 2018.

An FAQ covering this arrangement is available here:

http://www.enbridgeincomefund.com/Find-Shareholder-Information/Acquisition-FAQs.aspx

The default tax treatment for Canadians is to receive an automatic tax deferral for the ENB shares received. The initial adjusted cost base (ACB) for ENB becomes equal to a portion of the total ACB of the ENF shares, based on the proportional values of the ENB shares received and the cash consideration received at the time of the acquisition (the details of this will be illustrated in an example below). For a shareholders owning both ENF and ENB prior the acquisition, this value would be added onto the existing ACB for ENB.

Optionally, you may choose to claim an immediate capital gain rather than a deferral at your discretion by reporting the gain on your tax return. This would be calculated based on the market value of the ENF / ENB shares at the time of the acquisition.

The default tax treatment for Canadians for the cash payment of $0.45/share is the realization of a capital gain or loss. This capital gain or loss is calculated based on the difference between the cash payment and a portion of the total ACB of the ENF shares, also based on the proportional values of the ENB shares received an the cash consideration received at the time of the acquisition.

To calculate the portion of the ACB of ENF corresponding to the ENB shares received and the cash consideration received, we can look at the proportion of their values. The closing price of ENB on November 15, 2018 was $42.55, corresponding to a value of:

= $42.55 x 0.735 = $31.27

per existing share of ENF. The total value of the 0.735 ENB shares and the $0.45 cash consideration is therefore:

= $31.27 + $0.45 = $31.72

This results in:

= $31.27 / $31.72 = 98.5815%

of the ACB of ENF being allocated towards the ENB shares and:

= $0.45 / $31.72 = 1.4185%

of the ACB of ENF being allocated towards the $0.45 cash consideration.

The above values may vary slightly depending on the market value used for the ENB shares at the time of the acquisition. The market value for an ENF share just prior to the acquisition could also be used, resulting in a slightly different allocation.

There are no further tax consideration related to the accrued ENF dividend payment of $0.1883 per share, aside from their normal tax treatment as an eligible dividend. This dividend payment has no implication on ACB or capital gains.

Example:

Suppose you owned 1,000 shares of ENF just prior to the acquisition, with a total ACB of $20,000.00. You would receive:

- 735 shares of ENB (1,000 x 0.735)

- $450.00 in cash (1,000 x $0.45)

The default tax treatment would result in the ACB of the newly acquired ENB shares being equal to:

= $20,000.00 x 98.5815% = $19,716.30

based on the proportions calculated above. If you already held shares of ENB, this amount would be added to your ACB of ENB. The ACB corresponding to the cash consideration would be equal to:

= $20,000.00 x 1.4185% = $283.70

Therefore, you would realize a capital gain equal to:

= ($450.00 - $283.70) = $166.30

The initial ACB for the ENB shares would be established as $19,716.30.

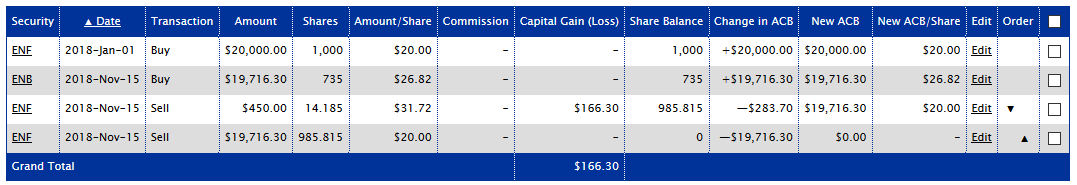

AdjustedCostBase.ca can help with these calculations. The acquisition can be represented with the following transactions (assuming you have already inputted any prior purchase and sale transactions for ENF):

- Sell 14.185 shares (1,000 shares x 1.4185%) of ENF on November 15, 2018 for a total amount of $450.00.

- Sell 985.815 shares (1,000 shares x 98.5815%) of ENF on November 15, 2018 for a total amount $19,716.30 (this should result in a capital gain of $0).

- Buy 735 shares of ENB on November 15, 2018 for a total amount $19,716.30.

This results would be as follows:

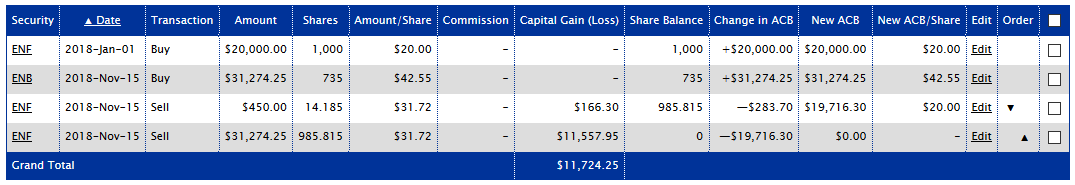

If you choose not to defer the capital gain corresponding to the ENB shares received, you can do so by modifying the sell transaction for the 985.815 shares of ENF to use a total amount of:

= $42.55/share x 735 shares = $31,274.25

with the same total amount for the buy transaction for 735 shares of ENB, as follows:

Shareholders also have the option of filing a Section 85 Election in order to defer any capital gains associated with the cash consideration. However, hassle with filing this paperwork may not be worthwhile unless you held a large holding of ENF with a low ACB per share.

Hello again, AdjustedCostBase.ca,

I have made it to the year 2019 for tracking my husband’s ACB for his Canadian holdings! There is one disposition that happened in 2019 that involves payment of a dividend. I found this blog post of yours, which also involves a dividend, and I’m wondering if you could please confirm that the dividend he received should be treated as in this Enbridge example.

In August 2019, the company Carmanah Technologies Corporation (CMH) merged with other companies and went private. Shareholders were paid a total of $7.35 per share for all shares held. A portion of this was paid in cash for the sale of the shares ($4.31/share). The rest was paid as a dividend ($3.04/share).

I found information related to this in the company’s management information circular posted on Sedar on July 17, 2019 (page 36 of the document, or page 51 of the PDF):

https://www.sedar.com/GetFile.do?lang=EN&docClass=10&issuerNo=00008441&issuerType=03&projectNo=02941171&docId=4557798

This is how it played out for my husband:

– On August 21, 2019, he sold 6 shares of Carmanah at $4.31/share for a total proceeds of $25.86.

– On August 21, 2019, he received a dividend on 6 shares of Carmanah of $18.24 total. This dividend appears on his T5 form for 2019.

Could you please confirm that this dividend is simply taxed as a dividend and does not need to be entered into AdjustedCostBase.ca for the purpose of calculating his capital gain/loss from the sale of the Carmanah shares?

I am thinking that I just need to enter the sale into AdjustedCostBase.ca as follows:

– Sold 6 shares of Carmanah for a total of $25.86 on August 21, 2019. (This generates a capital loss in his case.)

Brynn,

That document mentions that at the time Carmanah was waiting to hear on a CRA ruling to determine the tax treatment of the event. They later released another document confirming the tax treatment:

https://sedar.com/GetFile.do?lang=EN&docClass=8&issuerNo=00008441&issuerType=03&projectNo=02941249&docId=4557923

“Carmanah has now been informed by the CRA that it will rule that part of the proceeds received by shareholders in connection with the transaction will be a deemed dividend. The amount of the dividend received by each shareholder will be equal to the amount by which the proceeds of the shares sold (which will be C$7.35 per share) exceeds the paid up capital of the shares sold. The paid up capital is currently approximately C$4.32 per share and, as such, the deemed dividend will be approximately C$3.03 per share.”

Therefore you are deemed to have received a dividend of $3.03 per share and the proceeds of disposition are $4.32 per share. So you’re correct and the sale of the shares can be inputted into AdjustedCostBase.ca as a “Sell” transaction for $4.32 per share.

I’m not sure why the values you mentioned differ by a penny, but that’s obviously an insignificant amount.

Thank you for sharing that follow-up document, and for confirming the appropriate “Sell” transaction for this. And thank you for your generosity in helping people like me with these questions. It is amazing to be able to communicate with someone who has expertise in this area.

A couple of questions around how to handle the transaction when one company B acquires another A in a stock for stock swap.

1) If you are in a loss position of Company A must you realize that loss or can you still carry it forward to the new shares of Company B?

2) If you elect to carry forward your Cost base from Company A do you need to document anything on your tax return?

3) If you elect to realize the Gain/loss at the time of the Share swap of Company B for Company A, do you need do anything other then just report the Gain/Loss on your schedule 3?

Jeff,

The ability to carry forward your ACB or realize a gain or loss depends on the particular corporate event. You can check filings on SEDAR or the web site of the company/fund for details.

You can carry forward capital losses indefinitely, so there may not be any advantage to carrying forward your ACB vs. realizing the loss immediately if you are in a loss position.

In some cases you are required to make a section 86.1 election with the CRA in order to defer taxation:

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/information-canadian-shareholders.html