The superficial loss rule defines certain situations in which capital losses are disallowed. Section 54 of the Income Tax Act indicates that a superficial loss is a loss occurring from the sale of property when both of the following two conditions are met:

During the period that begins 30 days before and ends 30 days after the disposition, the taxpayer or a person affiliated with the taxpayer acquires a property (in this definition referred to as the “substituted property”) that is, or is identical to, the particular property.

AND

At the end of that period, the taxpayer or a person affiliated with the taxpayer owns or had a right to acquire the substituted property.

Overview of the Superficial Loss Rule

In cases where a superficial loss occurs, the capital loss cannot be claimed. Depending on the circumstances, the loss may be either permanently denied, denied but added to the adjusted cost base of any remaining or repurchased shares (with the effect of deferring the capital loss and reducing the capital gain when the remaining shares are eventually sold), or in some cases partially denied.

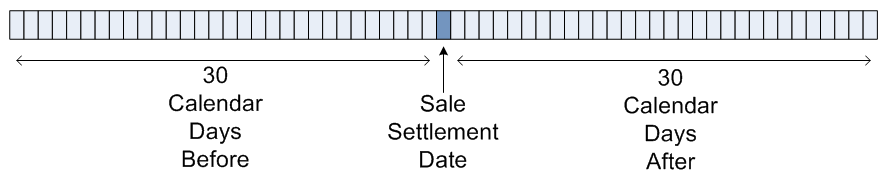

The superficial loss rule applies to the period beginning 30 days before the settlement date of the sale transaction for the capital loss in question, until 30 days after the settlement date. This encompasses a 61-day period (the 30-day period before the settlement date of the sale, the settlement date itself, and the 30-day period after the settlement date). This time period is illustrated in the diagram below:

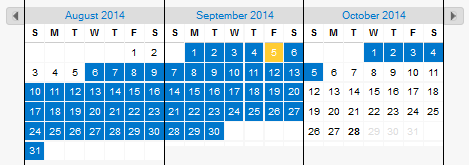

As an example, suppose that a settlement date for a sale occurs on September 5th, 2014. The 61-day superficial loss period would be from August 6th, 2014 to October 5th, 2014 inclusive, as shown below:

Note that this time period is defined in terms of calendar days — not business days or stock market trading days.

If a sale transaction triggers a loss, the superficial loss rule will apply if the following conditions are met: you’ve bought the same or identical property during this 61-day period, and you still own or have the right to acquire the same or identical property at the end of the 61-day period. In such a case, all or part of the capital loss will be denied.

The superficial loss rule is in place in order to prevent taxpayers from partaking in artificial transactions for the purpose of triggering an immediate capital loss. Without the existence of the superficial loss rule, a taxpayer would be able to sell shares, trigger a capital loss, then immediately repurchase the same shares. In other words, a capital loss could be harvested without any meaningful change in ownership. Note that if this were allowed, the total capital loss (or gain) over the holding period would be the same regardless of whether or not the loss harvesting transaction takes place (as we’ll see with some examples below). However, triggering the capital loss immediately has the advantage of providing a tax advantage sooner rather than later. This is because the capital loss can be applied against any capital gains right away, as opposed to when the shares are sold in a more permanent fashion in the future. This can be viewed as advantageous due to the time value of money (a dollar today is worth more than a dollar tomorrow). The purpose of the superficial loss legislation is to remove the advantage that would result from these kinds of artificial transactions.

To be clear, transactions that fall under the conditions of the superficial loss rule are not illegal (for example, they’re not akin to insider trading). You’re perfectly within your rights to engage in transactions that follow under these conditions. However, you must make sure that you don’t claim a capital loss in a case where it’s disallowed by the superficial loss rule.

Example #1

Let’s look at an example. Suppose that you purchase 100 shares of XYZ Inc. for $50 per share with a settlement date of January 6th, 2014. The ACB becomes $5,000 or $50 per share (assuming no transaction costs for simplicity). Then the share value declines to $30 per share. Let’s assume that you believe the shares are undervalued and that the share price will increase in the future so you want to maintain ownership of the shares. But with the decline in value, you see the opportunity to trigger a capital loss to reduce your tax bill for the current year. So, you sell all 100 shares on November 3rd, 2014 for $30 per share. You record a loss equal to $2,000 ((100 shares x $30/share) — $5,000). Then, because you’d like to maintain ownership, you repurchase 100 shares for $30 per share with a settlement date of November 4th, 2014 (since it’s only been a day, it’s likely that the share price hasn’t changed by much). Ignoring the superficial loss rule, your ACB becomes $3,000 or $30 per share. 5 years later, the share price has risen to $80. You sell your 100 shares with a settlement date of December 2nd, 2015, and realize a capital gain of $5,000 ((100 shares x $80/share) — $3,000). These transactions are summarized below:

Violation of the Superficial Loss Rule

| Settlement Date | Transaction | Shares Bought or Sold | Price Per Share | Share Balance | ACB | ACB per Share | Capital Gain (Loss) | |

|---|---|---|---|---|---|---|---|---|

| 1. | 2014-01-06 | Buy | 100 | $50 | 100 | $5,000 | $50 | – |

| 2. | 2014-11-03 | Sell | 100 | $30 | 0 | $0 | $0 | ($2,000) |

| 3. | 2014-11-04 | Buy | 100 | $30 | 100 | $3,000 | $30 | – |

| 4. | 2015-12-02 | Sell | 100 | $80 | 0 | $0 | $0 | $5,000 |

Note that the net capital gain over the holding period is $3,000 ($5,000 — $2,000). Claiming the capital loss for the November 3rd, 2014 transaction is not allowed according to the superficial loss rule. This is because a repurchase of shares happens within the 61-day period centred around the sale settlement date (specifically, the repurchase happens just 1 day after the sale). Also, the shares are still owned at the end of the 61-day period, satisfying the other half of the superficial loss rule.

In the table above, we have incorrectly assumed that the superficial loss rule does not apply and that the capital loss can be claimed. But according to the superficial loss rule, the loss should in fact be denied, and the amount should be added back to the ACB. So the transactions should be recorded as follows:

Applying the Superficial Loss Rule

| Settlement Date | Transaction | Shares Bought or Sold | Price Per Share | Share Balance | ACB | ACB per Share | Capital Gain (Loss) | |

|---|---|---|---|---|---|---|---|---|

| 1. | 2014-01-06 | Buy | 100 | $50 | 100 | $5,000 | $50 | – |

| 2. | 2014-11-03 | Sell | 100 | $30 | 0 | $0 | $0 | |

| 3. | 2014-11-04 | Buy | 100 | $30 | 100 | – | ||

| 4. | 2015-12-02 | Sell | 100 | $80 | 0 | $0 | $0 |

Applying the superficial loss rule results in a capital loss of $0 for November 3rd, 2014 and a capital gain of $3,000 on December 2nd, 2015. The denied capital loss of $2,000 is subsequently added to the ACB. The total net capital gain, $3,000, is the same as above when we ignore the superficial loss rule. Although the net capital gain is identical in both cases, the first interpretation of the transactions is likely to be more desirable from the taxpayer’s point of view due to the time value of money. But the CRA does not allow a capital loss to be claimed on November 3rd, 2014 because it’s deemed to be a superficial loss.

Example #2

As you can see, the superficial loss rule disallows claiming a capital loss when you sell shares and then repurchase them shortly after (within 30 days following the settlement date of the sale). But what about the other way around? What if you own shares that have declined in value – can you purchase more shares and then sell them immediately after to trigger a capital loss?

Let’s look at a second example, similar to the one above but with a slightly different set of transactions:

- January 6th, 2014: Buy 100 shares for $50 per share

- November 3rd, 2014: Buy 100 shares for $30 per share

- November 4th, 2014: Sell 100 shares for $30 per share

- December 2nd, 2015: Sell 100 shares for $80 per share

If we ignore the superficial loss rule, the transactions can be summarized as follows:

Violation of the Superficial Loss Rule

| Settlement Date | Transaction | Shares Bought or Sold | Price Per Share | Share Balance | ACB | ACB per Share | Capital Gain (Loss) | |

|---|---|---|---|---|---|---|---|---|

| 1. | 2014-01-06 | Buy | 100 | $50 | 100 | $5,000 | $50 | – |

| 2. | 2014-11-03 | Buy | 100 | $30 | 200 | $8,000 | $40 | – |

| 3. | 2014-11-04 | Sell | 100 | $30 | 100 | $4,000 | $40 | ($1,000) |

| 4. | 2015-12-02 | Sell | 100 | $80 | 0 | $0 | $0 | $4,000 |

Should the superficial loss rule apply here? It’s more common to discuss the superficial loss rule in cases where shares are sold and repurchased shortly after. But the superficial loss rule can also apply when shares are bought and subsequently sold. In this case both conditions of the superficial loss rule are satisfied: a purchase occurs during the 61-day period centered around the sale (it occurs the day before) and some shares are still held at the end of the 61-day period. So according to the superficial loss rule, the capital loss on November 4th, 2014 is denied.

The correct recording of the transactions is as follows:

Applying the Superficial Loss Rule

| Settlement Date | Transaction | Shares Bought or Sold | Price Per Share | Share Balance | ACB | ACB per Share | Capital Gain (Loss) | |

|---|---|---|---|---|---|---|---|---|

| 1. | 2014-01-06 | Buy | 100 | $50 | 100 | $5,000 | $50 | – |

| 2. | 2014-11-03 | Buy | 100 | $30 | 200 | $8,000 | $40 | – |

| 3. | 2014-11-04 | Sell | 100 | $30 | 100 | |||

| 4. | 2015-12-02 | Sell | 100 | $80 | 0 | $0 | $0 |

Note that in both cases the net capital gain over the entire holding period is $3,000 (this was also the case in the first example). The artificial transactions would not affect the net capital gain over the entire holding period, regardless of whether the superficial loss rule is applied. But in the first (incorrectly calculated) case, the cash flow would typically be considered better for the taxpayer due to the time value of money. Due to the superficial loss rule, the second account of the transactions must be used.

In these cases the superficial loss rule does not deny the loss permanently (although there are some cases where a permanent denial would occur). When the superficial loss rule is applied in both examples, the ACB is increased by the amount of the denied loss, so the capital loss (or reduction in capital gain) is deferred into the future.

Identical Property and Affiliated Persons: Additional Conditions for the Superficial Loss Rule

The definition of the superficial loss rule includes a couple of notions that require further explanation: identical property and affiliated persons. Shares of the same class of the same corporation would be considered identical property. However, shares of two similar companies, in the same industry, would not be considered identical property. Two ETF’s tracking the same index would be considered identical property. But if the ETF’s do not track the same index, they would not be considered identical property, even if they track the same sector, industry, or asset class.

The definition of affiliated persons includes yourself, your spouse, or a corporation, partnership or trust controlled by you or your spouse. If any of these individuals or entities purchase identical property within the 61-day period centered around a date you sell the property, the superficial loss rule will apply.

Also, special care needs to be taken for transactions within registered accounts, such as RRSPs, TFSAs, RRIFs, and RESPs. The superficial loss rule will apply when a sale outside of a registered account coincides with a purchase of identical property inside a registered account within the 61-day period. However, in these cases, the capital loss is permanently forfeited and cannot be added to the ACB of the non-registered shares. You could also think of this as if the ACB is added to the ACB of the registered shares, but since ACB does not apply to registered shares, it’s as if the capital loss is permanently denied.

You’ll need to consider more than just the transactions that occur within the same account. You’ll need to examine transactions occurring in all your accounts (including registered accounts) and other accounts controlled by you and your spouse.

Adding the Denied Capital Loss to Your Adjusted Cost Base

In the examples above, where a combination of a sale and repurchase occurs in the same account, the denied capital loss is directly added back to the ACB. In situations where the repurchase occurs in a different account, the denied capital loss should be added to the ACB of the shares in the account where the repurchase occurs.

For example, suppose you sell some shares at a loss and the next day your spouse repurchases the same shares. This would indeed trigger the superficial loss rule and the capital loss would be denied. In this scenario, the denied capital loss should be added to your spouse’s ACB, not your own ACB.

Similarly, when you sell some shares at a loss in your non-registered account and repurchase the same shares the next day in your RRSP account, the superficial loss rule applies. In this case the denied loss would be added to the ACB for the RRSP account since that’s where the repurchase occurred. But ACB is completely meaningless in the context of a registered account since capital gains within the account are not taxable. This is why the application of the superficial loss rule between a registered and non-registered account results in the loss being permanently denied.

What About “Superficial Gains”?

Since the superficial loss rule denies capital losses under certain circumstances, you might ask, can capital gains be avoided in certain cases? For example, if you sell shares and realize a capital gain, but immediately repurchase the shares, can you call this a “superficial gain” and defer the capital gain? The answer is no: you cannot defer the capital gain and there is no such thing as a “superficial gain.” The capital gain is taxable immediately in the current tax year, even if the shares are repurchased within 30 days.

Capital Account vs. Income Account

The descriptions above apply for transactions recorded on capital account. If the transactions are on income account, different rules will apply. Some of the conditions that the CRA uses to decide whether your trading activity is on income account may be heavily correlated with the conditions for triggering the superficial loss rule. For example, the CRA may consider your transactions to be on income account if you trade frequently and have short periods of ownership — two conditions that go hand in hand with the superficial loss rule.

The conditions for your trading activity to be considered on income account are complex and can be open to interpretation, so you should seek the help of a professional if you’re unsure where you stand.

When Shares are Fully Sold Quickly After Being Purchased

How about when shares and bought, and then fully sold immediately after? Can a capital loss be claimed in this case? As long as all the shares a sold, and you don’t repurchase the shares within the 30-day period following the sale’s settlement date, you can claim a capital loss. Remember that two conditions must apply for the superficial loss rule: shares must be bought within the 61-day period, AND, some shares must still be owned at the end of the period. In the case where all shares are sold (and nothing’s repurchased) the superficial loss rule does not apply as long as you don’t own any shares at the end of the 61-day period.

Again, this is assuming that you’re trading on capital account. A high trading frequency and short holding period could result in your transactions being considered on income account (see above).

How Can You Avoid the Superficial Loss Rule?

To avoid triggering the superficial loss rule, you can simply wait. After you’ve bough shares, make sure to wait at least 30 days before selling them (unless you sell all your shares). After you’ve sold shares, make sure to wait at least 30 days before repurchasing them. Note that share prices can fluctuate wildly over this time period, so there’s a risk that the share price can increase substantially by the time you plan to repurchase the shares.

Another option is to repurchase, similar, but not identical property. For example, you could purchase shares of another company in the same industry, or you could purchase another ETF tracking a different index.

Options and Superficial Losses

In Section 54 of the Income Tax Act, the definition of the superficial loss rule includes the following:

“for the purpose of this definition…a right to acquire a property (other than a right, as security only, derived from a mortgage, hypothec, agreement for sale or similar obligation) is deemed to be a property that is identical to the property”

This suggests that for the purposes of determining the superficial loss rule, call options and their underlying shares are deemed to be identical properties. Therefore, the superficial loss rule applies in each of the following situations, assuming that you also still own shares or call options on those shares at the end of the superficial loss period:

- Call options are sold at a loss and the underlying shares from those call options are bought during the superficial loss period.

- Shares are sold at a loss and call options on those shares are bought during the superficial loss period.

- Call options are sold at a loss and call options on the same shares are bought during the superficial loss period. This is the case even if the call options differ in strike prices and expiry dates.

The Income Tax Act specifies that the superficial loss rule does not apply when the disposition is the expiry of a call option.

AdjustedCostBase.ca and the Superficial Loss Rule

AdjustedCostBase.ca has a feature to identify when superficial losses occur (but only in some cases). The tool also allows you to manually apply the superficial loss rule to your sale transactions. Further details on this are provided here.

Conclusions

Indeed, the superficial loss rule can be tricky and cumbersome to follow. A large onus has been placed on taxpayers to understand the rules and apply them towards calculating capital gains and losses. It’s been argued that the superficial loss rule is a “trap for the unwary, unknowledgeable, and unlucky.” The superficial loss rule has been criticized for being easy to circumvent by knowledgeable people aiming to harvest capital losses, while also easy to inadvertently violate by those without any ill intentions. But for the time being, Canadian investors must either take precautions not to violate the rule, or recognize when the rule applies and defer capital losses accordingly.

Hi, thanks for another informative post. To be clear: if I bought (more than 30 days ago) 100 shares of something for $100 each, and today I sell half of them for $90, I can still claim this as a capital loss? (assuming I don’t re-purchase them)

Thanks

Hi Tyler,

You’re correct that in that scenario the superficial loss rule would not apply. Although one condition (you still own shares after the 61-day period) for the superficial loss rule has been met, the other condition (buying shares within the 61-day period) has not been met.

Hi, ty for the in depth info and example. I have a question similar to Example 2. For instance: If the settlement date of the last sell was “2014-11-05” instead of “2015-12-02” (assume no more repurchase) how will the (captial gain / loss) deferred? Will it still be reported in April 2015 or 2016 since on CRA website stated “If you have a superficial loss in 20XX, you cannot deduct it when you calculate your income for the year.

Thankyou!

Jordan,

Assuming the settlement date for the last sale transaction were 2014-11-05 in Example 2, the superficial loss rule would not apply to either sale transaction. Although shares are purchased within the 61-day period, the second condition of the superficial loss rule is not satified: no shares would be still owned 31 days after 2014-11-05 nor 31 days after 2014-11-04. You’d be able to claim the entire capital loss for the 2014 tax year.

Hi, ty for the quick reply. Sorry I didn’t stated my second question too clear. Using Example 2 again, If the entire stock were sold on 2015-12-02 with a (capital loss of $3000 instead of gain). Will the capital loss gets claim on 2015 tax year or will it get deferred to 2016…etc, since you mention it gets deferred into future when a superficial loss occurs.

Thankyou!

If all shares are sold on 2015-12-02 the superficial loss rule would not apply as long as no shares were still held at the end of the 61-day period (2016-01-01). The capital loss can be claimed for the 2015 tax year.

Thank you so much everything it’s clear for me on the superficial loss rule now, really appreciate your effort on helping.

You’re most welcome, Jordan!

Regarding superficial loss, if you buy in and out of a stock several times throughout the year, but sell it all before December (no more purchases within the last 30 days of the year) does it matter? All the gains and losses would have to be claimed for that year anyway. In other words, if all your purchases and sales of a stock were between January and November of the same year, does it matter? Thanks in advance!

SS,

That’s correct – the net capital loss or gain would apply for that year, as long as no more units are owned 30 days after the last sale. The superficial loss rule may cause losses in the earlier transactions to be deferred, but in this particular case this has no effect on capital gain/loss reporting since all the transactions occur in the same year.

Does the superficial loss rule apply to capital losses due to disposition of foreign currency cash? With a foreign currency brokerage account, it strikes me that unless it was being used very infrequently, that nearly all capital losses due to currency exchange would classify as a superficial loss.

JJ,

I’m not aware of any exemption to the superficial loss rule for foreign currency cash.

This post has been a big help. In my specific case, with regard to Example 1, could I claim the final capital loss of $3000 because of transactions in my non-registered even though I continue to hold shares of the same stock in my RRSP at the time? Note that I made no purchases of the stock in the 61 day window in any account.

If you didn’t make any purchases in the 61-day window but still own shares 31 days following a sale that triggers a capital loss, the superficial loss rule does not apply and you’re eligible to claim the loss. For the superficial loss rule to apply, both of the conditions mentioned must be met.

Hi, first of all I’d like to thank you for writing up this guide, its incredibly helpful. This will my first time filing for taxes, I have some transactions I’m not entirely sure about as to whether or not they break the superficial tax loss rule. If you could clarify whether or not any of these transactions break that rule I would really appreciate it!

[redacted]

Flame,

I would suggest that you enter these transactions into AdjustedCostBase.ca. In many cases a warning will be shown when the superficial loss rule may apply, as described here:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-with-adjusted-cost-base-ca/

Note, however, that further information would be required in some cases to determine with certainty whether the superficial loss rule applies (such as transactions in your spouse’s accounts, in registered accounts, and transactions involving other property that would be considered identical).

How is the situation handled where a stock in a company held in a non-registered account is sold at a loss and repurchased the next day in a registered account (RRSP) but sold 29 days after re-purchase (i.e. just within the 30 day time limit) so that no stock remains in either account 30 days after the first sale. Having no stock left in either account would appear to satisfy the second requirement and thus allow the capital loss in the non-registered account to be recognized.

If the above argument is valid then presumably the stock could be repurchased in the non-registered account again the next day.

Along the same line using Example 1 and assuming all transactions are within a non-registered account, what if the second sale of the stock in the Example was just within the 30 day limit such that no stock of this company remained in the account after this second sale. Presumably the capital loss of the first sale would be recognized because it meets both criteria. Then what if the stock was repurchased the next day just beyond the 30 day limit of the first sale assuming this was arranged so the settlement date of the purchase would occur in the following year. Presumably this new purchase would trigger the superficial loss provisions once again but it is not clear at what ACB. In any case it would appear this should allow the loss to be used in the previous year. Please comment on this.

Thanks,

Harold

Harold,

Regarding your first question, yes, you would be able to apply the capital loss since the second condition of the superficial loss rule is not satisfied. (As long as the dates you’re talking about are settlement dates and not trade dates. It’s important to be careful about the trade date vs. settlement date when pushing the boundaries of the superficial loss rule window. The window is defined in terms of calendar days, and a trade towards the end of the week could push the settlement date into the following week due to weekend days or holidays, which could put it outside the window.)

For your second question, could you provide and example with specific transactions and dates? I would also encourage you to try this out using AdjustedCostBase.ca, as you should see warning if the superficial loss rule is violated (in cases like this where all transactions are in a non-registered account, and as long as all relevant transactions are inputted).

Here is an example:

Transactions

Date Trans Amount Shares Amt/Share Gain (Loss) Share Balance Change in ACB New ACB New ACB/Share

2014-Jan-02 Buy $10,000 100 $100 100 $10,000 $10,000 $100

2014-Dec-01 Sell $5,000 100 $50 -$5,000 0 -$10,000 $0

2014-Dec-02 Buy $5,000 100 $50 100 $5,000 $5,000 $50

2014-Dec-31 Sell $5,000 100 $50 0 -$5,000 $0

2015-Jan-02 Buy $5,000 100 $50 100 $5,000 $5,000 $50

The above is a modified excerpt from the transactions in adjustcostbase.ca. It was not clear to me that the date to be provided in the calculator is to be the transaction date or the settlement date. I assumed the settlement date as the transaction date would appear to be meaningless as far as interpretation of the Act. Transaction dates would have be 3 business days earlier if that worked out (i.e. a day when the markets are open). Otherwise some adjustment to the settlement dates in this example would be required. It was also not clear to me whether to select the “Apply Superficial Loss Rule” button in the calculator or not. In applying it the calculator simply disallowed the loss. However as of December 31 there are no shares of the Company in the account at the 30 day limit after the December 1 Sell date (i.e at the end of the day on December 31 there are no shares). So it would then seem that the loss for this transaction should be allowed.

Harold,

For the sell transaction on 2014-Dec-01 there are no shares owned after 30 days later, so the superficial loss rule would not apply in either case. For the sell transaction on 2014-Dec-31, shares are still owned after 30 days, so the superficial loss might apply, however, in this case the sale of 2014-Dec-31 has a capital gain of $0. Since there is no loss, the superficial loss rule is not applicable.

See the following for an explanation about trade dates and settlement dates:

http://www.adjustedcostbase.ca/blog/understanding-trade-dates-and-settlement-dates/

And a tutorial about using the “Apply Superficial Loss Rule” option on AdjustedCostBase.ca is available here:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-with-adjusted-cost-base-ca/

Thanks for all the information. It seems the spaces between the columns of the example disappear when posting which makes for difficult reading. In any case, my example shows a purchase of 100 shares on Jan 2, 2015 which is the first trading day in 2015 and 2 days after the second sale. So in my example I am showing ownership of shares within the 30 days of the second sale but not the first.

Harold,

Sorry for the confusion. I’ve updated my response above.

Hi There,

I would love some help here. I recently sold a stock for a 43k loss….29 days later I repurchased the stock and made 10000 in the day and sold it. I realize my mistake now but just wondering what the tax consequences will be? Also I am interested in repurchasing this stock and am wondering if somehow if I can make capitla gains if that could offset the initial loss of 43k.

thanks very much,

Bob

Bob,

It looks like the superficial loss rule would apply for the first sale and the $43k loss would be initially denied. But the amount of the denied loss should be added back to the ACB for the repurchased shares. Although I can’t say with certainty without knowing all the details, it would appear that due to the ACB being increased by $43k, the gain of $10k may actually be a capital loss of $33k ($10k – $43k).

Hi, thanks for the examples on this blog. It makes things quite clear.

I was wondering what they mean by “right to acquire”?

Andy,

This refers to stock options – specifically owning call options.

Hi,

Just found out I may have made a mistake. Incorrect advice from my on line brokerage!

I recently sold all the shares of a stock (1000) for a 21,100K loss. A week later I bought back 200 shares at 13.00. After reading your articles I assume this means I can only claim the other 800 shares for a capital loss. Is this correct. How do I figure out the ACB of the the 200 shares I now own. Original share price was $36.00

Thanks for your help.

Sherry,

It sounds like the superficial loss rule would apply in your case, however, it would only apply to a portion of the capital loss. Further information about this subject can be found here:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

Hello,

Thanks for the in depth information regarding this important topic. Here is the situation I will like clarity on. I buy and sell same stock ABC on the same day (i.e. stock is sold the same day it was purchased) and this happens everyday throughout the year. Most of the times I sell for gain and at other times I sell for loss such that the net at the end of the year is positive (gain). Note that when I sell, I sell in full (not partial sell). Here are now my questions based on this:

1. For all the transactions (buy/sell) that happen in the same year, can I use my capital gains to offset my losses as capital losses?

2. If the answer to question 1 is YES and considering the 61-day requirement, will losses I make in the last 30 days of the year trading the way I explained qualify to be claimed as capital losses against capital gains for the year if the losses and gains settled by the last settlement day in the year? Or I the loss activities in the last 30 days of the year will trigger superficial loss situation?

3. Can I use the capital gain I made from daily buying/selling to offset the capital loss from sale of another stock XYZ that I actually held for over 3 months and never purchased it again more than 3 months after selling it for loss?

4. You wrote about “Capital Account” and “Income Account” and how CRA may view an account as income account if the stocks in the account trade frequently and are held for short period like I currently do. In this case will making an election to CRA using for T123 allow the account to always be treated as “Capital Account” despite the high frequency of trading and short holding period?

Your answers and comments to each of these questions individually will be very much appreciated.

Warn regards,

Jacob

Hi,

Could you please clarify: does the superficial loss rule apply if I am a high frequency trader reporting trading profits as business income (income account)?

Many thanks,

Stephen

Stephen,

The superficial loss rule is only applicable on capital account, not on income account.

After selling a stock for a loss, what happens if I immediately sell naked puts on the same underlying and a) they expire worthless or b) the naked puts are closed out for a profit/loss?

Thanks!

Marc,

I believe that the superficial loss rule would not apply (assuming no other transactions around the same time) as you would not own any shares or the right to acquire shares after the sale of the stock. For further information on calculating capital gains for stock options please see the following page:

http://www.adjustedcostbase.ca/blog/adjusted-cost-base-and-capital-gains-for-stock-options/

how do you calculate the acb for shares bought with a discount given by company of your employment. what is claimed as cap gain/loss, what cost base is used, the discounted price upon purchase or the real price it was purchased at. will the discount need to declared as part of employment income as taxable benefits? thanks a lot in advance.

Roz,

I’m hoping to address the topic of employee stock options in a future post.

Jacob,

1. If you’re fully selling your entire position at the end of each day, then I don’t believe that the superficial loss rule would apply. Although the first condition for the superficial loss rule above would be met, the second condition would not be. This you should be able to use all capital losses to offset capital gains.

2. Yes, in this case you should still be able to claim losses for trades that settle in the last 30 days of the year in that same year. However, whether or not the superficial loss rule applies will depend on whether you own the shares at the end of each of the first 30 days of the following year. As long as you continue your strategy of liquidating at the end of each day than I don’t think the superficial loss rule would apply.

3. Capital losses can be used to offset losses for capital gains resulting from any capital property (not just the gains from identical property). These losses can be applied against gains for the current year, or be carried back up to 3 years, or be carried forward indefinitely (for further information about this please see http://www.adjustedcostbase.ca/blog/applying-capital-losses-to-previous-tax-years/).

4. I hope to address the issue of capital account vs. income account in a future post. In the meantime some additional information about this is provided by the CRA here: http://www.cra-arc.gc.ca/E/pub/tp/it479r/it479r-e.html.

So what if you sold some shares but still held many more, received your dividends and that was automatically used in a drip and repurchased a few shares within 30 days? It was kind of an accident and I need to know what to do as it affected a loss that I wanted to claim on that sale although only partially.

James,

The superficial loss rule could still be triggered in that case, despite it being a DRIP and despite it being an accident. However, it’s likely that only a small portion of the loss would be denied (see http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/).

Hello AdjustedCostBase.ca,

To try and better understand the superficial loss rule, I entered both Example #1 and Example #2 (your examples from this posting) into adjustedcostbase.ca. Example #1 returns with a warning that the superficial loss rule may apply. Example #2 returns no warning about the superficial loss rule. Any insight as to why Example #2 returns no warning would help my understanding of the superficial loss rule.

Thank you.

jmc,

Thank you for reporting the issue. It should be resolved now and you should see the warning for both cases.

If i buy 100 shares of a stock for $120 in year 1 and then sell 200 (becomes net short position of -100) at $260 in year 2 what is the tax treatment?

Does this change if instead i said the stock was actually usd currency? I buy 100usd for 120cad and then buy 260cad worth of US shares using 200usd (100usd is “borrowed” or shorted).

Struggling with the tax treatment for USD denominated futures (obviously using leverage) as i know how to calculate the capital gains on futures but not sure about the currency. The way the USD has appreciated seems like i get hit paying gains on the futures related to currency (on the borrowed funds) but the loss incurred on shorting USD never gets realized because i don’t plan to convert my USD back to CAD anytime soon.

Your advice is appreciated.

John,

Gains and losses on short sales are generally considered to be on income account as opposed to capital account (with a few exceptions such as when the short forms part of a hedge position).

AdjustedCostBase.ca,

Thank you for your quick reply to my comment and for resolving the issue. Both Example #1 and Example #2 return a warning about the superficial loss rule.

Do I report a sell that results in a superficial loss?

If no, do I just keep tracking ACB as usual? If yes, I am not clear how to report a sell that results in a superficial loss. If I am understanding correctly, from a sell transaction using adjustedcostbase.ca, the absolute value of the “change in ACB” is the ACB of the units sold. If this is correct, when the superficial loss rule is applied to the sell transaction, the ACB of the units sold becomes equal to the sell amount (or proceeds of disposition).

Do I report the sell on Schedule 3 with Proceeds of Disposition and Adjusted Cost Base being the same value resulting in a gain (or loss) of zero?

Thank you.

jmc,

The CRA isn’t clear about whether they want transactions involving superficial losses to be reported on Schedule 3. In cases where the superficial loss rule reduces a capital loss to zero, I would suggest not reporting the loss as it could cause confusion. If you would like to still report the loss then the adjusted cost base can be changed such that it equals the proceeds of disposition less the commission.

Would Class A shares of a mutual fund and class F shares of the same mutual fund be considered “identical properties” for the superficial loss rule?

(The only real difference between Class A and Class F relates to fees. Class F units have lower fees and are only available for sale through an investment advisor (who charges his or her own additional fees!)).

P.S. I found a similar discussion on the internet. It looks like the CRA does not consider voting and non voting common shares of a company (e.g. Class A vs Class B) “identical properties” unless there is a right of conversion (to non voting shares) attached to the voting shares. But I am not sure how that logic extends to Class A vs Class F units of a mutual fund. Often one is able to convert the class F units to class A units (typically if you fired your advisor and transferred converted class A units to a discount brokerage account). Is that a right of conversion?

Anyone have any insights?

Hi there,

Thank you for posting this informative article. I have a question about how to calculate my new ACB in the case where I have repurchased the shares I had just sold the day before for a lower price. Here is the example:

I own 1000 shares with a an ACB of $80 per share.

I sell 500 shares at $75 for a capital loss of $2500 plus $10 in commission expenses.

I buy the 500 shares back the next day for $70 plus $10 in commission expenses.

How do I calculate my new ACB? Do I include the commission expenses into the ACB?

Have the transactions above resulted in a capital gain that needs to be claimed in the tax year (assume all these transactions occurred within the same tax year.

Thank you for your time and consideration in responding to these questions.

Michael,

There would be a capital loss of $2,510 ((($75/share x 500 shares) – $10) – ($80/share x 500 shares)). Assuming that there are no other transactions, both conditions for the superficial loss rule would be met, indicating that this is indeed a superficial loss.

In that case, the superficial loss should be added back into the ACB, resulting in a total ACB (after the repurchase) of:

$80,000 – $40,000 + $2,510 + ($70/share x 500 shares) + $10

= $77,520

Note that this can be calculated on AdjustedCostBase.ca as described here:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-with-adjusted-cost-base-ca/

Thank you for the response. Much appreciated. It seems so simple now that I see it. I knew I had generated a superficial loss, but I couldn’t figure out whether or not I had to claim a capital gain since I had repurchased the shares at a lower price. Now I see the logic of that specific ACB calculation.

Thanks again for your reply.

Just came across this article and wanted a clarification on options. If I sold shares to create a loss but immediately bought some call options on stock to continue to have exposure to it, then sold the options and bought the stock back 30+ days later does this still trigger a loss or with the exposure to the options would the CRA consider this a superficial loss?

Jim,

That would depend on the timing of when you sold the options. If you sell the options within 30 days after you sold the shares, then the loss on the sale of the shares would be a superficial loss. If you sell the options after 30 days, then the loss on the sale of the shares would not be a superficial loss.

CORRECTION: If you sell the options within 30 days after you sold the shares, then there would be no superficial loss. If you sell the options after 30 days, however, there would be a superficial loss since you would still own the right to buy shares 30 days after the sale of the underlying shares.

I had some shares that were below purchase price. I transferred those shares from a personal account to a joint account with my spouse. I assume I triggered a superficial loss?

Now when we do dispose of those shares is the adjusted cost base only on my 50% of the shares or the entire amount of the shares? The shares have risen considerably and would result in a capital gain from both the original price I paid and the transfer price.

Example purchased $10, transferred at $5, sold joint at $20.

thank you for your assistance

Maxx,

I believe the superficial loss rule would be triggered in that scenario. The superficial loss can be added to the ACB, resulting in a capital gain of $20/share when the shares are sold.

Your response to Jim (Aug 30, 2016)

“If you sell the options within 30 days after you sold the shares, then the loss on the sale of the shares would be a superficial loss. If you sell the options after 30 days, then the loss on the sale of the shares would not be a superficial loss.”

seems to conflict with what you told Medalic in Dec 2015: “The superficial loss rule can be triggered by a sale of the underlying shares if you own call options at the end of the superficial loss period (since call options constitute the right to acquire the underlying shares).”

I am thinking the original (Dec 15) response is correct.

Would you please clarify.

Thanks

Bob

Bob,

Thank you for reporting the error. You’re right and I have corrected the comment above.

In regard to EXAMPLE#1- It appears that the STL rule should not apply since the purchase of the shares were not made within the 61 day window. The second condition obviously has met met – although the first condition, that the shares need to be bought within the 61 day period does not seem to have been met since the buy date was 11 months previous to the sell date.

Can you please explain why?

THX

R Nicholson..

Ralph,

The first condition for the superficial loss rule is satisfied in Example #1 because a purchase occurs on 2014-11-04, one day following the disposition on 2014-11-03.

Hi,

What about the ACB of USD? Let’s say I have 10,000 USD sitting in my unregistered account, with ACB of 14,000 CAD (for simplicity, those are the only USD that I own in all my accounts).

I transfer the whole 10,000 USD to my TFSA account @ 1.32 exchange rate (so my 10,000 USD x 1.32 = 13200 ==> my capital loss is 800 CAD if I am doing a deemed sell/acquisition).

Is this a superficial loss, and thus denied since the “Buy” is happening in the TFSA account?

Thanks.

Please note that for my example I am transferring the USD “in kind” (I am not selling them to CAD, trasnfering the CAD to the TFSA account, and buying back the USD).

Sorry – I missed something. Let’s assume in my example that I hold 20,000 USD with ACB = 28,000 CAD.

I transfer 10,000 USD to my TFSA account @ 1.32 exchange rate. The questions are:

1. Is there a capital loss (of $800 CAD)?

2. What is the resulting ACB of the 10,000 USD that are kept outside the registered account (14,000 CAD, 14,800 CAD?).

Thanks.

PS: sorry for the multiposting.

Jose,

Yes, I believe the superficial loss rule would apply, regardless of whether or not the transfer of USD is in kind. If you hold USD$20,000 with an ACB of $28,000 and transfer USD$10,000, then the resulting ACB of the remaining USD$10,000 would be $14,000.

Thanks. So… how do you avoid this from happening?

1. Sell/exchange the USD 10,000 in the non-registered account so you have CAD 14,000.

2. Transfer the CAD 14,000 to the TFSA account.

3. Wait 31 days and exchange the CAD 14,000 for whatever amount of USD you get at that time.

a) This operation wouldn’t have any impact in the ACB of the USD (in the non-registered account).

However, what happens if you get dividends from US stocks (in the held registered and/or the non registered account) or paid wages (I am an independent professional, and I do get paid in USD) before the 31 days? Seems to me that my capital losses in USD$ will keep getting deferred forever (I get dividends and salary in USD every month, which I guess it is like a “deemed acquisition” of USD, so no matter when I sell my USD I will always have a “buy” of USD inside the 31 days window).

I was looking in your blog but didn’t see an entry specially dedicated to this. I’d humbly suggest one – I think it is complex enough and I am sure I am not alone out there.

Thank you so much.

Jose,

Yes, you could circumvent the superficially loss rule by converting the USD to CAD, transferring the proceeds, and waiting 31 days to convert CAD to USD in your TFSA.

Since superficial losses are deferred as opposed to lost forever (unless you transfer the money into a registered account) then the deferred losses may eventually allow you to offset capital gains in USD depending on how the exchange rate fluctuates in the future.

Also, triggering the superficial loss rule does not necessarily mean that the full capital loss is denied. In the scenarios you’ve described it seems likely that you would be able to at least claim part of the loss:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

There is also some further information about foreign currency cash here in case you didn’t see it:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-for-foreign-currency-cash/

Thank you!

Hi.

I am currently an employee of a US company in Canada. I get Restricted Stock Units (RSU’s) from the company. I previously had stock from the company. Recently in 2011, the company started selling some shares when the RSU vested in order to provide the CRA with the tax for the RSU’s. Since I had previous stock which were much higher priced my ACB was much higher than the RSU’s I received. This lead to the stock sale for tax purposes being a capital loss.

The question is since the stock sale was involuntary and was done by the company and it was done either on the same day/next day that the stock was received, in this case is it considered a superficial loss?

Can the RSU’s be considered an option so it can be claimed as a capital loss? Also since the sale was done in my account and was involuntary, since I am not a related to the company except as an employee, can it be considered not an affiliated relationship so again I can claim it as a capital loss.

Thanks in advance.

So if I understand this correctly – it’s only a superficial loss if you sell SOME shares within the time period.

If you completely cash out and sell everything – there is no superficial loss. However – you need to wait 30-31 days to buy back in, otherwise it would be a superficial loss then.

Day 1: Buy

Day 2: Sell partial

= superficial

Day 1: Buy

Day 2: Sell everything

= capital loss

Wasn’t even aware of this. Now my tax bill is a lot higher. Expensive lesson 🙁

Adrian,

The first scenario would result in a superficial loss, unless the rest of the shares are sold within the superficial loss period. Also note that likely only part of the loss would be considered a superficial loss.

I’m not understanding then. I thought that unless you fully sell out of all your shares – then the superficial rules apply (provided you buy/sell in the timeframe).

If I purchased shares and sell a portion a week later – does that not qualify since I bought:

1) Within the 30 days prior

2) Did not fully cash out?

I’ve gone over the article again and again.

Adrian,

You are right. But note you need to sell all your shares IN ALL YOUR ACCOUNTS (including non-registered, RRSP, TFSA etc) by the END of the period.

Example 1

Day 1. Bought shares of Security X

Day 2: Sold Shares of Security X at a loss

Day 3: Bought shares back

Day 32: You still own the shares of Security X.

Superficial loss rule applies. You cannot claim the loss.

Example 2

Day 1. Bought shares of Security X

Day 2: Sold Shares of Security X at a loss

Day 3: Bought shares back

Day 28 You sell all your shares of Security X for a GAIN!! You are RICH!!

Day 32 You have NOT bought back any shares of Security X. You do not own any shares of Security X in ANY of your accounts including RRSP, TFSA etc.

You can claim the superficial loss for the day 2 trade since you do NOT own any shares at the end of the 30 day period after the sale. (In this case, you would also have to claim the capital gain on Day 28!)

OOPs. I should have said, “You can claim the capital loss for the day 2 trade….”

Got it thanks. So to recap very quickly…

If you sell for a loss within < 30 days of buying, all shares need to be sold in all accounts so that rule #2 isn't satisfied (still owning property).

Once 30-31 days has passed after a buy order, you can sell partial shares at a loss without worry of superficial losses.

So in my case….

Transactions:

———-

BUY

BUY

BUY

BUY

BUY

etc… (lots of previous buys to this point)

Then…

2/22/2017

———-

Buy (32,615)

Total ACB = $13,218.19

3/9/2017

———

Sell (32,000)

Loss = (-$407.45)

Total ACB = $10,740.73

3/10/2017

———

Sell (60,000)

Loss = (-$1,055.23)

Total ACB =$6,095.49

I still owned shares 30 days after the initial sell… so my question is then…

1) Would I add the loss of -$407.45 to the Total ACB on 2/22/2017?

2) Then I would add the loss of -$1,055.23 to the next Total ACB?

Which means it should now be:

2/22/2017 = $13,218.19 (Total ACB)

3/9/2017 = $13,625.64 (Total ACB)

3/10/2017 = $14,680.87 (Total ACB)

I know understand your situation. You have a number of partial dispositions of shares.

There are two ways to handle this situation.

1) Fully deny the superficial loss. If you do that, it is my understanding that you would add the superficial losses to your ACB; OR,

2) Partially deny the superficial loss. Generally you can only do this if the number of shares remaining after the sale is less than the number of shares sold.

The formula you use is as follows:

Superficial Loss = (min(S, P, B) / S) x (Total Capital Loss)

where S is the number of shares sold, P is the total number of shares acquired during the 61-day superficial loss period, and B is the number of shares remaining at the end of the superficial loss period. Note that min(S, P, B) indicates the minimum value among S, P and B.

e.g. The total capital loss= $80

Superficial Loss Calculated = $20

THAN MEANS YOU CAN CLAIM A CAPITAL LOSS OF $60. (i.e. $80-$20)

For more details, see

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

You have not provided enough details to determine where option 2) is a real option for you.

My understanding is that you can always use option 1).

In both cases, the superficial capital loss(es) you calculate is not permanently denied but just deferred (assuming the transactions occurred in a non-registered account).

P.S, To verify your ACB calculations, I would just use this website. It is very easy to use.

Very detailed – thanks! I went ahead and used the tool.

This is the result: http://image.prntscr.com/image/1c91bdf2aa9248f6a35e9d4c6a16a351.png

I left the field blank for “Adjusted Cost Base” based on your response to someone else on the other page. By leaving it blank – this just defers and adds it onto the existing ACB correct? if I was to enter a number in this field, it would calculate percentage of capital losses allowed. I rather defer and keep it simple.

Adrian,

That looks correct. As Rob mentioned above you may be able to claim part of the loss, however, you may choose to fully defer the loss for simplicity.

Adrian,

The screenshot looks right.

But I do not see a field called “Adjusted Cost Base”.

There is a field called “Adjusted Capital Loss”. If you were going to defer the whole superficial capital loss, you would enter 0 into that field. You would also tick “Add Reduction in Capital Loss to ACB”. Looks like that is what you did.

As noted above, sometimes you can optionally claim a partial capital loss depending on the circumstances. (e.g. typically if the number of shares remaining after the sale is less than the number of shares sold). It does not look like you can claim a partial capital loss in your case.

But if you could claim a partial capita loss, you would use his formula:

Superficial Loss = (min(S, P, B) / S) x (Total Capital Loss)

where S is the number of shares sold, P is the total number of shares acquired during the 61-day superficial loss period, and B is the number of shares remaining at the end of the superficial loss period. Note that min(S, P, B) indicates the minimum value among S, P and B.

You would then calculate the allowable capital loss as follows:

Allowable Capital Loss = Total Loss – Superficial Loss

Then you would enter the value for “Allowable Capital Loss” into the field of the website called “Adjusted Capital Loss” and still tick “Add Reduction in Capital Loss to ACB”.

Hope this helps.

I hope someone can answer this question relating to superficial loss rule and RRSP’s

e.g. May 1 — Buy 900 shares of stock ABC

May 2 — Buy 100 shares of stock ABC

May 5 — 100 shares of stock ABC was bought in a RRSP!!

May 10 — Sell 1000 shares of stock ABC for a loss of $1000

31 days after the original sale, 100 shares of stock ABC is still held in the RRSP. None are held in the non-registered account.

The superficial loss rule does apply.

Is the entire capital loss of $1,000 permanently denied? Or is just 10% of the loss permanently denied since one only bought 100 sharers in the RRSP.

Adjustedcostbase.ca author,

In your response to Adrian the other day you wrote, “The first scenario would result in a capital loss…”

Did you mean to write “superficial loss” instead of “capital loss”?

Andy, I agree with you. I am sure the Adjustedcostbase.ca author really meant to say “superficial loss”. In my view, the first scenario as described would have resulted in a superficial loss since he never sold all the shares. (ie. he still held shares at the end of the superficial loss period).

But as noted, it is possible that only part of the loss was superficial and the other part of the loss was a real capital loss that could be claimed on your taxes. (It would depend on the circumstances).

See

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

Rob,

I believe that only 10% of the loss would be considered a superficial loss:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

S is 1,000, P is 1,100 and B = 100, resulting in 10% of the loss being a superficial loss.

Thanks, Andy. I’ve updated the response above.

Thanks AdjustedCostBase.ca! That makes a lot of sense.

But I found out that my friend’s situation is a little more complicated. I do hope you can help.

e.g. Jan 1 — Bought 700 shares of stock ABC in RRSP

Jan 1 — Buy 500 shares of stock ABC in Regular Account

May 2 — Buy 500 shares of stock ABC in Regular Account

May 5 — Buy 700 shares of stock ABC in RRSP!!

May 10 — Sell 1000 shares of stock ABC in Regular Account for a loss of $1000

31 days after the original sale of 1000 shares, 1400 shares of stock ABC is still held in the RRSP. None are held in the regular non-registered account.

The superficial loss rule does apply. Since 1000 shares were sold at a loss, 1200 shares were bought during the superficial loss period (between the two accounts) and 1400 shares remain in the RRSP, I suspect one cannot claim any capital loss. (The number of shares purchased exceeded the number of shares sold).

The real question is how does one allocate the Superficial losses between the two accounts (Regular and RRSP). Given the circumstances, I assume that one can allocate some of the superficial looses to the regular account in order to increases the ACB of any subsequent purchases in the regular Account.

Since 1200 shares were purchased between the two accounts, does one allocate the losses as follows:

Superficial Losses allocated to RRSP = shares bought in RRSP / (Shares bought in RRSP and Shares bought in Regular Account) x total capital Loss

i.e. Superficial Losses Allocated to RRSP = 700/(700+500) x $1000 = $583.33

And therefore the Superficial Loss allocated to Regular Account would be = $1000-583.33 = $416.67

Does this make sense?

Also please comment on how one could use any superficial losses allocated to the regular account.

I assume one would have to make a subsequent purchase of stock ABC at ANY time in the future. Then would could add the superficial losses to the Adjusted Cost Base (ACB) of the purchase. Is that right?

Alternatively, you just use the formula:

Superficial Loss in RRSP = min (1000, 700, 1400) / 1000 x $1000 capital loss = $700

where 1000 is the number of shares sold in regular account, 700 is the number of shares bought in RRSP and 1400 is the number of shares remaining in all accounts (ie. 1400 in RRSP).

I think one just ignores the number of shares bought in regular account during the superficial period since all the shares are sold in the regular account by the end of the period.

Than means the Capital Loss in the Regular account that could be claimed = $1000-700 = $300

This is simpler. So it is probably the right way. Any thoughts?

Rob,

I believe you’re correct that the superficial loss rule would apply in that scenario and that $700 of the $1,000 loss would be considered a superficial loss, resulting in an allowable capital loss of $300.

But I’m not sure that the superficial loss can be added to shares purchased in the future in a non-registered account. According to IT-456R:

http://www.cra-arc.gc.ca/E/pub/tp/it456r/it456r-e.html

“If the taxpayer realizes a capital loss in such circumstances, subsection 85(4) deems the loss to be nil and, together with paragraph 53(1)(f.2), provides for the loss to be added to the ACB of the taxpayer’s remaining shares.”

“Paragraph 53(l)(f) permits the owner of the substituted property to add the amount of a superficial loss in determining the owner’s ACB of that substituted property.”

If you interpret that statement literally then the superficial loss would be added to ACB of the shares remaining in the registered account, not future shares purchased in the non-registered account. But ACB is not applicable to shares in a registered account, so increasing this ACB is of no value. So it would seem that the capital loss is permanently denied. This is similar to the scenario where a capital loss is permanently denied when shares are transferred in-kind from a non-registered account to a registered account.

Thanks. After further review, I agree that it is unlikely that any superficial loss can be added to the an ACB of zero for subsequent purchases of shares. My first suggested approach does look like it will work.

But I do think my second alternative approach is right. At the end of the superficial loss period, I have reacquired 700 shares albeit in the RRSP and sold 1000 shares. The superficial loss in the RRSP is $700 as calculated as follows:

Superficial Loss in RRSP = min (1000, 700, 1400) / 1000 x $1000 total capital loss = $700

This superficial loss is permanently denied since the superficial loss is added to the ACB of the shares in the RRSP. And as you pointed out ACB’s are meaningless in RRSPs;

The superficial loss in the Regular account = min (1000, 300, 0) x $1000 total capital loss = 0

So it looks like to me that one could claim a capital loss of $300 in the regular account as follows:

Capital Loss to be claimed in Regular Account = Total Capital loss – Superficial loss in RRSP – superficial loss in regular account

Capital loss to be claimed = $1000 – $700 – $0 = $300

Make sense?

Rob,

That looks correct to me – a permanently denied superficial loss of $700 and an allowable capital loss of $300.

I believe the formula should be:

min (1000, 1200, 700) / 1000 x $1000

but the end result is the same.

Hi,

Do you know if performing a Norbert’s Gambit would trigger the superficial loss rule?

For example,

Let’s say I buy DLR.TO (ETF holding CAD currency) TODAY, and then immediately after purchasing the DLR.TO I contact the broker and have them journal the shares over to DLR.U.TO (ETF holding USD currency) then after waiting T+3 days for the trade to settle, I sell DLR.U.TO to gain US cash. This is within 30 days, but it is a different ETF since it holds different currency, so I assume this will not trigger a superficial loss rule, but is this correct?

Vito,

Journaling DLR to DLR.U should not trigger a deemed disposition. They are the same security (with the same CUSIP).

Hello! I need your help…

basically I made money this year trading, lost all of it, repurchased the same shares (company) within 30 days and made all the money back….now im worried i’ll be double taxed on the money I lost then made back? how would that work? appreciate a response!

also say I bought stock and made $1000, sold then rebought the next day and lost the $1000, then rebought again two days later but only made $200 back. what would happen in that situation?

Eric,

Assuming all of these transactions occurred within the same year, it would not make any difference whether the $1,000 capital loss is considered a superficial loss or not. Since a superficial loss can be re-added back to the ACB of repurchased shares, the total capital gain/loss would be the same. In your example, the total capital gain would be $200 either way ($1,000 – $1,000 + $200) assuming all of these transactions occur within the same year.

ok interesting. now what if you are dealing with an odd number of shares in each transaction? say the superficial loss involved 100 shares, and when you rebought the same stock a few days later you purchased only 70 shares?

let me make a guess here that the ONLY negative aspect regarding a superficial loss is that that loss, unlike a regular capital loss, cannot be carried forward to future years? is that basicially it in a nutshell? my primary concern here is paying capital gains tax on money that I lost via a superficial loss but it looks like that does not happen. I really appreciate the feedback!

I also have one more question that’s unrelated. If you are a day trader and your capital gains are taxed as income by the CRA, ive heard the superficial loss rule does not apply? meaning all they care about is your net income for the year regardless of superficial losses meaning all losses are treated the same? A loss is a loss under the income system unlike the capital gains/losses system?

again thanks!

Oh and one thing I forgot to ask…does it matter if you have 2 superficial losses in a row? or do they just keep getting pushed forward via ACB. thanks again.

Eric,

Information on handling partial superficial losses is available here:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

A superficial loss means that the loss is denied. In certain circumstances, the denied loss can be re-added back to the ACB of repurchased shares, which has the effect of reducing the capital gain (or increasing the capital loss) when the shares are eventually sold in a non-superficial loss situation.

The superficial loss rule only applies for transactions treated on capital account, not on income account.

Yes, it’s possible to have multiple subsequent superficial losses.

Hello

I have a current loss in my broker cash account. I want to transfer this stock to my TFSA and keep the stock. The broker said they can do the transfer without selling it. But a disposition would occur and it would be reported to the CRA. Can I use this as a capital loss even though I am not selling it but transferring it? Can I use this as a capital loss if I transfer it from a non registered account to a registered account? I already have this stock in my TFSA.

Brad,

First, that seems highly unusual that your brokerage would not allow you to transfer stocks in-kind. You may want to double check with them about this.

If the stock is held in a TFSA, then you do not need to worry about the superficial loss rule. Capital gains and losses are not incurred in registered account.

Thanks, the broker told me I can sell in my cash account, transfer the $ to my TFSA and then re-buy it in my TFSA after 30 days ($18 total cost) or they can transfer it instantly over the phone ($25 cost).

But to clarify if I move this stock (either in-kind or what they suggest for $25) from the cash account to a TFSA then I am NOT allowed to claim any loss because its ending up in registered account? Or can I claim the loss?

Its sounds better that I just sell the stock, collect the capital loss and then re-buy in my TFSA 30 days later?

Brad,

Sorry I misunderstood and assumed you were talking about transfer a stock from a registered account into a non-registered account.

If you transfer a stock into a TFSA or other registered account in kind at a loss, then that loss will be a superficial loss.

To avoid the capital loss being deemed a superficial loss, you would need to sell first, then wait at least 30 days, then repurchase.

Yes, my understanding is that if you transfer stocks in kind from a non-registered account to a registered account it will be a deemed disposition and if there are capital gains, then there will be tax owing to the CRA. However, if transferring the stocks in kind and generating a capital loss, you cannot claim that loss. If this is the scenario for you, it may be best to sell the stocks, take the loss and then be able to claim the loss when filing taxes, then with the proceeds re-purhcase the same security after 30 days time to avoid the superficial loss rule.

Depending on what stock you are buying, there are creative ways around the superficial loss rule. For example, I’ve read that investors who are buying individual stocks, say for example Apple, if they lose in value and decide to sell to trigger a capital loss, but you’re still interested in apple stock because you believe it will go up in the future, you can immediately re-purchase (within 30 days of selling the shares) a mutual fund or ETF that holds Apple stock as a heavy weighting and this should not trigger the superficial loss rule. Kind of cool, but I’d rather just wait the 30 days and re-buy the same stock.

Thoughts ACB.ca?

Moneyhelp,

Yes that’s correct – you can repurchase an ETF that has similar holdings without triggering the superficial loss rule (although the superficial loss rule still applies when you sell an ETF and repurchase a different ETF that tracks the same index).

It will most likely be difficult to find an ETF that holds such a large proportion of the stock you sold. For example, Apple is the largest holding of the PowerShares QQQ ETF, but only amounts to 12% of total assets. But in such a case holding the ETF may be acceptable if the other holdings have a high degree of correlation to the stock you’ve sold.

Interesting, however, I’ve also read that the CRA will not accept the capital loss claim even if your spouse/common law buys the same same stock within 30 days of the other spouse/common law selling the same stock.

How is this fair? I just mean, perhaps there may differing opinions of how the company stock will fair in the immediate future. Is it unrealistic to assume there could be differing of opinions within 30 days? And, if this is correct, where the above is not acceptable with the CRA, how about doing the same scenario but with a trusted friend or sibling, etc? Does it only apply to people’s significant other?

Cheers.

Moneyhelp,

The superficial loss rule applies when the repurchase is done by an “affiliated person”, which the CRA says includes the following examples:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/capital-losses-deductions/what-a-superficial-loss/affiliated-persons.html

”

– you and your spouse or common-law partner;

– you and a corporation that is controlled by you or your spouse or common-law partner;

– a partnership and a majority interest partner of the partnership; and

– after March 22, 2004, a trust and its majority interest beneficiary (generally, a beneficiary who enjoys a majority of the trust income or capital) or one who is affiliated with such a beneficiary.

”

I suppose the rationale is that in many cases a person would be indifferent between owning an asset themelves or their spouse owning that same asset.

Ok,

So I sold 180,000 shares of a company at $2.38 originally bought at $2.60.

Then having sellers remorse within 30 days I bought back 100,000 the shares at $2.35. The shares are now at $3.80 which is good but what is my ACB going forward? I have no plans to sell the shares this year.

Leaving out commissions to simplify….

Original cost of shares was $468,000 ACB of $2.60

Sale of shares resulted in $428,400 at a price of $2.38

Resulting in a loss of $39,600

Bought back 100,000 shares for $235,000 within 30 days.

So I’m assuming the loss on 100,000 shares would be denied meaning 100,000 x $.22 = $22,000

This is where I get confused. This denied loss somehow works into my new ACB of $235,000 or $2.35 a share. It gets added in? IE my new average cost base on that 100,000 shares is $257,000 or $2.57 a share?

Bob,

If you apply the superficial loss rule to the entire capital loss, then the full $39,600 would be added to the ACB of the repurchased shares, resulting in a total ACB of $274,600.

But you have the option to claim part of the capital loss, as described here:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

Under these rules, the superficial loss would be ($39,600 x (100,000 / 180,000)) = $22,000. This would be added back to the ACB of the repurchased shares, resulting in a total ACB of $257,000 for the 100,000 repurchased shares, and you can claim an immediate capital loss for the remainder of $17,600.

Ok thanks!

It sounds like my numbers were generally correct but I may have gotten to the in a round about way. I’ll claim the partial capital loss to get it on the books moving forward and the new ACB.

Another quick question about another stock if you wouldn’t mind….sorry if this is getting annoying but thank you greatly for your help and this site.

For the period from August 1 to Aug 3 – I bought 25,000 shares of stock W at an average of 2.22

On Aug 22th I sold 10,000 of these shares at $2.45 for a profit of $2300 leaving me with 15000 shares.

On Aug 30th I bought another 5000 shares at $2.14 bringing me back up to 20,000. One of my questions is….at that point is my average cost base just based on the original 15000 ACB/price plus the new cost/price of the new 5000 shares? IE the fact that previously I sold 10,000 doesn’t even work into the equation as I sold them at a profit?

So at that point on August 30th I had 20,000 shares at whatever ACB is appropriate.

Then on October 24th I sold those 20,000 shares at $2.10 creating a loss based on whatever ACB was appropriate for the 20,000 shares.

To further complicate the sitution I bought back 5000 shares a week later at $2.00 creating a superficial loss on 5000 of the shares sold on Oct 24th.

I guess at this point I understand everything in this trading mess other than the question about what my ACB would be on the 20,000 I ended up with on Aug 30th after selling 10,000 of the 25,000 at a profit and then buying back 5000 at a lower price.

Bob,

After selling shares your ACB per share remains the same after selling shares, but your total ACB is reduced. But when you repurchase shares, your total ACB and ACB per share will be based on the proportion of shares before and after the repurchase, which is affected by the number of shares previously sold, so the number of shares previously sold does factor into ACB calculations.

You can try inputting these transactions into AdjustedCostBase.ca to see how the ACB changes during this sequence of transactions:

This is after reducing the capital loss on Oct. 24 from $2,000 to $1,500 due to the partial superficial loss.

Thanks again

Hi and thanks for this great information and website. Do you (or anyone) know of some stand alone software that will track ACB and Superficial losses for Windows or Mac?

Steve,

AdjustedCostBase.ca can help identify cases where the superficial loss rule applies. More information on this feature is available here:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-with-adjusted-cost-base-ca/

Yep saw that. I was hoping for something to use offline (like a PC app or something) in case your great site goes away in the future….something like Quicken. But I don’t think it does that.

Hello ACB,

I own $100k of a security which I purchased early last year ($32.50/share). On 29 Jan 2018, I purchased another $6k of the same security ($33/share). Today (14 Feb 2018), I have a net $5k loss on my entire position (now worth $31/share). I want to sell today my entire position to harvest the capital loss of $5k. I don’t intend to re-purchase the same security within 30 calendar days of the settlement date. The hiccup is that I purchased that $6k of the same security within the 30 calendar days before the sale settlement date (if I were to sell today).

Would you be able to help me in figure out whether in my particular case, the superficial loss applies, and if so, how to calculate it? Thanks.

Jon,

No, the superficial loss rule would not apply in that situation. One of the conditions is that you still hold the same security 30 days after the sale, which is not the case if you’ve sold the entire position and don’t make any more purchases within 30 days after the sale.

Hi ACB,

As per Jon’s question, I would have thought the SLR would apply in this situation provided he sells his entire position today.

Let me explain and please correct me where my logic may be incorrect.

Scenario 1:

He bought $6K worth of securities on January 29, 2018 and he would like to sell his entire position TODAY which would be February 14th, 2018, which is LESS than the 30 days required to wait to qualify for a claimed capital loss, therefore triggering the SLR.

OR

Scenario 2:

Does the SLR only apply if he bought the securities on Jan/29/2018 and sold it today February 14th, 2018 and then re-purcahse again before March 14th, 2018 (ie. within 30 days of the February sale)? If this is the case, then does that mean, the SLR only applies on the RE-PURCHASING of the same security?

Personally I think the first scenario is correct, but maybe they’re both wrong, I don’t know, my brain is hurting. 😛

Thanks.

Moneyhelp,