Occasionally a stock split occurs whereby the number of shares in a corporation is increased. For example, a 2-for-1 stock split doubles the number of outstanding shares. Each share is essentially divided into 2, such that each shareholder owns twice as many shares after the split occurs. All else being equal, the market capitalization will be unaffected, and each share will have a market value equal to half of the pre-split market value.

In terms of adjusted cost base, the total ACB is unaffected. However, the ACB per share decreases according to the split ratio. For example, suppose a shareholder owns 100 shares of Royal Bank (RY) with a total ACB of $5,000. The ACB is ($5,000/100 shares) = $50 per share. After a 2-for-1 split occurs, the shareholder will receive 2 shares for each share owned, resulting in 200 shares. The total ACB remains the same at $5,000. However, the ACB per share is now equal to ($5,000/200 shares) = $25 per share.

Although less common, reverse splits can also occur. For example a 1-for-2 ratio indicates that the number of shares will be cut in half. Similarly, the total ACB will remain the same but the ACB per share will increase accordingly.

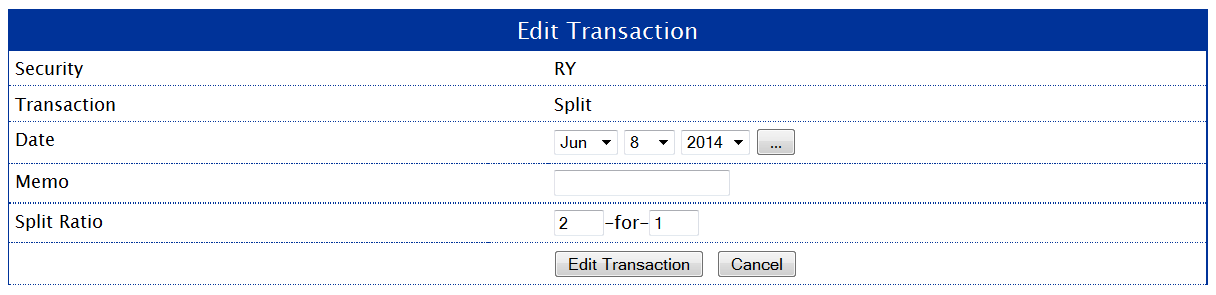

AdjustedCostBase.ca supports the reporting of splits. Following the example above, a split transaction can be entered as follows:

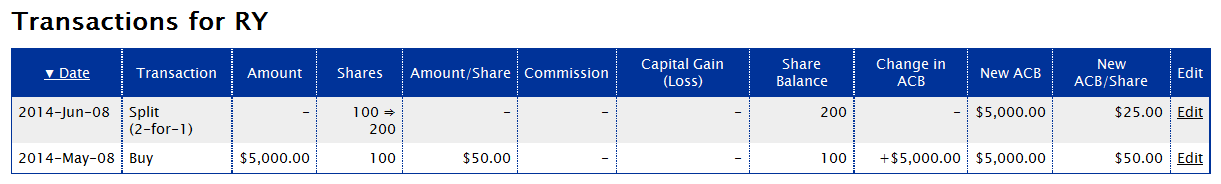

The affect of this transaction on the ACB is shown here:

The number of shares is increased from 100 to 200, the total ACB remains the same, and the ACB per share changes from $50 to $25.

Just wondering, if there is a reverse split (say, 2 shares are joined to become 1), and I’m holding 101 shares, I receive cash for the odd share. How does this affect the ACB calculation?

Thanks.

Tyler,

The single share would be deemed to have been sold, and the proceeds would be equal to the cash received.

For example, let’s say that you held 101 shares of ZYX with a total ACB of $1,010 (or $10 per share). You receive $15 in cash for the odd share right before a 1-for-2 split. This results in a capital gain of ($15 — $10) = $5. The total ACB then becomes ($1,010 — $10) = $1,000 (still $10 per share). After the split, the total ACB remains $1,000 but the ACB per share is now $20 since there are now 50 shares.

When entering these transactions on AdjustedCostBase.ca be sure to set the date for the sale of the odd share at least one day before the date of the split transactions. This is because the sale of the odd share occurs pre-split.

Thanks for the quick response, makes sense. Just to make sure, though: do you mean a capital gain of ($20 – $10) = $10?

Tyler,

Sorry for the confusion and thanks for catching that. I’ve updated the comment above.

How do I enter common share consolidation? BCE consolidated shares when they spun off Bell Alliant however I am not sure how to enter this in the calculator.

jamie

Jamie,

For the Bell Aliant spin-off from BCE in 2006, you’ll find an example calculation in this page:

http://www.bce.ca/transactions/bell-aliant-regional-communications-income-fund

“Assume that you own 250 pre-consolidation common shares having an aggregate tax cost of $5,605 and that the value of your unit entitlement and / or the whole and fractional units that were sold on your behalf was $605 (250 x 0.0725 = 18.125 units, with an assumed value of $33.40, for a total of $605). The tax cost of your consolidated common shares would be determined as follows:

“Calculation of BCE cost – 250 pre-consolidation common shares x 0.915 = 228.75 consolidated common share

“The tax cost of the pre-consolidation common shares of $5,605 is reduced by $605 as a result of the distribution of the units which distribution is received tax-free. The remaining $5,000 is the tax cost of the 228.75 consolidated common shares and $605 is the tax cost of the units received and / or the whole and/or fractional units that were sold on his or her behalf.”

For this example, you could enter the following transactions on AdjustedCostBase.ca:

1. Buy 18.125 units of Bell Aliant for a total cost of $605.38.

2. Buy 0 units of BCE for -$605.38 (a negative value) (to reduce the ACB to reflect the transfer of capital from BCE to Bell Aliant).

3. A 228.75-for-250 share split (or 0.915-for-1) for BCE (to adjust the number of shares based on the ratio of consolidation).

Note that there are further complications for this case, such as fractional units being sold, or cash being received instead of Bell Aliant units for shareholders with less than 150 shares.

Thanks so much for walking me through this. I’ll give it a try. You guys are great!!

0 share or negative value (sell/buy $) can’t be entered in adjustedcostbase.ca. So spin-off can’t be done by adjustedcostbase.ca.

RC,

Thank you for reporting the issue. You should now be able to input a negative value for buy transactions and record as spin-off as suggested above.

I’m having a terrible time figuring out what happened after a reverse split of 1:3.

Before the split I had 78,732 shares for a total ACB of $6,095.49

After the split: 26,244 shares

The total ACB should be the same amount – but when I multiply the new shares by the new average price showing in my brokerage (.23) – I am getting $6,036.12

New Shares * New Avg price = $59.37 lower

Do you have any ideas what is going on?

AB,

Is it possible this is due to a rounding error?

Before, the reverse split your ACB per share should have been ($6,095.49 / 78,732 shares) = $0.07742/share. After the reverse split the ACB per share would become 3 times larger – $0.23226/share. If your brokerage is displaying this value rounded to the nearest penny that could explain the discrepancy.

There are also many other reasons that your brokerage may calculate your ACB incorrectly:

https://www.adjustedcostbase.ca/blog/can-you-rely-on-your-brokerage-for-calculating-adjusted-cost-base-and-capital-gains/

Hello,

Brokerage displays the new total as $6095.49 which it should – as the total wouldn’t change, just share and per share ACB. Brokerage also only shows two decimal points.

When I enter in the split into the tool on this site as well – it also shows $6095.49 as the new ACB with the correct # of new shares.

I think when I calculate it manually and it’s coming up as $6036.12 – it’s because there are only two decimal places (.23 instead of .23226)

For tax purposes though – the ACB never changed – so it should be $6095.49 just like it was before, correct?

AB,

Total ACB should remain the same for a typical split (while ACB per share gets multiplied or divided according to the split ratio).

Hi,

I helping a friend, they have a drip for a bank stock for several years. In one transaction I see a normal drip bought of 87 shares with total cost of $4846.69, but then I noticed what appears to be a sold transaction of 87 with the description indicating a TFROUT which I assume is a transfer out to cash. Do I still enter into ACB the bought, how do i handle the transfer out?

I am also having a problem with a stock split resulting in receiving cash in lieu of a fractional share. My broker did not include that cash received in either the investment income summary report of the gain and loss report, so I have treated it as return of capital.

Jim,

I’ve always treated cash received in lieu of fractional shares as a deemed disposition, with the proceeds of disposition being equal to the cash received, resulting in a capital gain or loss.

Hello. I’m trying to figure out how to report a CIL ( cash in lieu ) that I received as a result of a spin-off from. I haven’t dealt with this before and am pretty confused. I understand to treat it as a disposition but I’m stumped in my tracking of ACB.

I held shares in ORX and the spinoff company was PORE. From their News Release: “Orefinders shareholders will receive one free Power Ore share for every 16.44 shares in Orefinders”

I held 100,500 shares of ORX at the time, so by simple math I should have got 6,113 shares of PORE. Anyways, my account only shows that I “ACQ” acquired 6,011 shares of PORE.

A second transaction then showed up about a week later, showing CIL (cash in lieu) for .23 cents.

On my holdings page, the average cost for the PORE shares show as .05 cents in my account. I’m assuming 6,011 * .05 = $300.55 (which is what TD shows)

What do I do with this .23 cents? Do I list this as a sale of 4.6 shares at .05 cents each for a gain of .23 cents, which just ends up equaling out to $0 in gains, but reduces my ACB by .23 cents?

I forgot to include a screenshot along with my post above ^ Here it is:

http://i.prntscr.com/577SqDHYQWuGOZqOZwDa8w.jpeg

I believe this is correct? Since the cost basis was $0 for the new company/shares .. just not sure if I can make it fractional shares on Schedule 3 reporting?

Adrian,

The tax treatment of spin-offs can vary on a case-by-base basis, so it’s probably best to inquire with their investor relations department of try to find this information on their web site.

For example, often a spin-off is treated on a tax deferred basis, whereby a portion of the ACB is transferred from the existing company to the new company, resulting in no immediate capital gain. In other cases, the value of the new shares received may be taxable as a dividend based on the fair market value of the shares at the time of the spin-off, with the ACB of the new shares becoming equal to this fair market value.

With regards to cash in lieu, most likely this should be treated as a sale of the fractional shares for the value of the cash received, which will result in a capital gain or loss. I believe the 16.44 share ratio was an approximation, which may have changed at the time of the spin-off. So I would suggest inquiring with the company about the actual ratio, and then you should be able to calculate the number of shares corresponding to the cash in lieu.

In your example for Tyler (ZYX corp), you say “This results in a capital gain of ($15 — $10) = $15.” Presumably that should be “… ($15 — $10) = $5”.

Also, you say “be sure to set the date for the sale of the odd share at least one day before the date of the split transactions. This is because the sale of the odd share occurs pre-split.” But it shouldn’t matter whether the sale is deemed to take place before or after the split: if before, you sell *1* share at the pre-split cost-per-share of $10; if after, you sell *0.5* share at the post-split cost-per-share of $20. Either way, the cost of shares sold is $10.

Michael,

Thanks for pointing out the error – I’ve made the correction in the comment above.

Yes, that’s correct, you can record the sale of odd shares after the split if you adjust the number based on the split ratio.

Hi,

I had 67 shares of HEICO CORP.

SPLIT 5-for -4, 67 = 83.75 shares

I received 16 shares (16 +67 = 83 shares) and they gave me 44.48$ = (.75shares)

Now I have 83 shares.

How entering these transactions on AdjustedCostbase.ca

Thanks

Michel,

This can be inputted into AdjustedCostBase.ca as the following transactions in this order:

1. 5-for-4 split

2. Sell 0.75 shares for $44.48 (this should result in a capital gain or loss)

According to the CRA’s IT115R2:

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/it115r2/archived-fractional-interest-shares.html

“if the value of the cash or other non-share consideration received by a taxpayer in this manner does not exceed $200, the taxpayer may either calculate and report the gain or loss on the amount received in lieu of the fraction of a share, or ignore that calculation and reduce, by the amount received, the adjusted cost base of the shares received.”

It may therefore be acceptable to choose to consider the cash received as return of capital, as it’s less than $200. However, I’m not clear on whether this applies to splits as the document seems to focus on the exchange of different shares. In this case, the split could be inputted into AdjustedCostBase.ca as follows:

1. 83-for-67 split

2. Return of capital for a total amount of $44.48

Thank you for helping me and for this fabulous work!

Hi,

As I wrote before

I had 67 shares of HEICO CORP. (us account)

SPLIT 5-for -4, 67 = 83.75 shares

I received 16 shares (16 +67 = 83 shares) and they gave me 44.48$ = (.75shares)

Now I have 83 shares.

I did:

1. 83-for-67 split

2. Return of capital for a total amount of $44.48 but I forgot to mention it was 44.48 US$

Do i have to convert 44.48$ in CAN$ to calculate my new ACB?

Thank you

Michel,

Yes, that amount should be converted into CAD$. Any amounts from prior transactions such as the initial purchases should also be converted into CAD$. AdjustedCostBase.ca allows for amounts to either be inputted directly in CAD$, or in a foreign currency with the exchange rate specified.

Hi

I was asking this question because there is no check box to click in foreign currency with the exchange rate on return of capital.

But that’s not a problem i will calculate it manually.

Thank you very much !

Michel,

I believe that in almost all (or all) cases distributions from foreign companies or funds are considered foreign income, even if they’re considered to be the equivalent of return of capital in the other country.

Which company/fund are you referring to?

If you wanted to input a return of capital amount in a foreign currency, then yes, you can convert the amount manually to CAD$.

Hi,

As mentioned before,

I had 67 shares of HEICO CORP. CLASS-A (US account)

SPLIT 5-for -4, 67 = 83.75 shares

So, I received 16 shares (16 +67 = 83 shares)

and they gave me 44.48$ = (.75 shares) (fractionnal split) instead of

.75 shares.

Now I have 83 shares.

I did:

1. 83-for-67 split

2. Return of capital for a total amount of $44.48US$ = 60.46CAN$

So they gave me $60.46CAN$ instead of. 75 shares and now i have 83 shares rather than 83.75 shares

Since it is a residual, I think it is not considered as an additional amount.

Am I right?

Michel,

That looks correct to me.

Thank you for your patience and for all your assistance.

Hi

Thanks for a great website and blog. I read the above post and comments but am not very clear on how to handle stock exchanges when company A acquires company B that are a combination of cash and stock. Specifically, I had shares in BRCM in 2 accounts that were converted to AVGO when AVGO acquired BRCM in 2016 as follows (all amounts in USD)

1. 100 BRCM shares converted @ $51.483 cash + 0.02424 AVGO shares resulting in proceeds of $5148.3 cash + 2 AVGO shares with the fractional 0.424 AVGO shares sold at $124.5664 for cash-in-lieu of $52.82

2. 100 BRCM shares converted @ 0.4378 AVGO shares resulting in 43 AVGO shares with the fractional 0.78 AVGO shares sold at $124.5664 for cash-in-lieu of $97.16

3. Fractional 0.344 BRCM shares redeemed @ $51.483 for cash of $17.71

Assume that the ACB of the 200.344 BRCM shares was CAD $10,017.2 (CAD $50/share) and the USD/CAD exchange rate was 1.404.

Is the conversion a deemed disposition that should be reported as a sale of BRCM and buy of AVGO? If not, how should the ACB be computed?

I suppose the fractional portions should be reported as follows:

– Sell 0.344 BRCM @ 51.483 * 1.404 (USD/CAD exchange rate) for capital gain of (0.344 * 51.483 * 1.404) – (0.344 * 50) = CAD $7.67

– Reduce ACB of BRCM shares to CAD $10,000 i.e. still CAD$50/share

– Sell 0.424 AVGO shares @ $124.5664 * 1.404 for proceeds of CAD $74.1539. Is the cost basis then CAD 50/0.4378*0.424 with a similar calculation for the 0.78 fractional share from the 2nd account of 100 BRCM shares?

but how should the share conversions themselves be reported?

Thank you very much for any help here.

Sanjay

Sanjay,

The CRA allows for your ACB to be transferred between shares for foreign spin-offs provided certain conditions are met and provided you have filed an election. Further information is available here:

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/foreign-spin-offs.html

It does not appear that Broadcom /Avago is on the list of the CRA’s list of eligible foreign spin-offs:

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/eligible-spin-offs.html

If the election for section 86.1 does not apply, then this would be considered a disposition of the original shares followed by a purchase of the new shares. The amount for the disposition should be the fair market value of the old shares immediately prior to the exchange, which should correspond to the cash received plus the fair market value of any new shares received (all converted to Canadian dollars).

Several years ago I purchased 2500 ETF shares over the course of three transactions at different values. Subsequently the shares had four reverse splits down to 78 shares. I sold all of those shares for a loss. For the purposes of reporting to the CRA, how do I reflect the separate purchases, subsequent splits, and eventual loss?

Hi,

Any guidance on how to enter the BIP.UN/BIPC stock split/special dividend? This official PR[1] says it should be a non-event. However, what makes it special and difficult to handle is that the split is occurring over 2 securities.

The PR says: “On March 31, 2020, the holders of BIP’s limited partnership units (“BIP units”) of record as of March 20, 2020 will receive one (1) class A exchangeable subordinate voting share (the “Share”) of BIPC for every nine (9) BIP units held, or approximately 0.11 Shares for each BIP unit. The Shares will be structured with the intention of being economically equivalent to BIP units, including identical distributions, and each Share will be exchangeable at the option of the holder for one BIP unit at any time. The Shares will allow investors the ability to own the equivalent economic exposure to BIP but through a traditional corporate structure.”

BEP.UN is planning the same thing later this year

Thanks again,

[1] https://www.globenewswire.com/news-release/2020/03/10/1997875/0/en/BROOKFIELD-INFRASTRUCTURE-ANNOUNCES-RECORD-DATE-FOR-UNIT-SPLIT-AND-CREATION-OF-BROOKFIELD-INFRASTRUCTURE-CORPORATION.html

Patrick,

Details on Brookfield Infrastructure Corporation unit split are now available here:

https://www.adjustedcostbase.ca/blog/tax-treatment-of-the-brookfield-infrastructure-lp-unit-split-and-creation-of-brookfield-infrastructure-corporation-bipc/

Hello, Which date should be used when entering a stock split transaction? Canadian Natural Resources Limited annonced a 2-for-1 split of its common shares with June 3, 2024 as the record date and June 10, 2024 as the payment date. Thank you.

Karim,

You should use the record date, though please note that the exact date may not be relevant unless you have purchases and sales in close proximity to the time of the split. Ensure that the share balance is correct following the split.