The Canada Revenue Agency requires taxpayers to report capital gains on foreign currency when the transactions are on capital account. Adjusted cost base must be calculated in Canadian dollars in a similar fashion to securities. When you convert Canadian dollars into a foreign currency, the adjusted cost base is established in Canadian dollars. When the funds are later converted back into Canadian dollars, a capital gain or loss will be realized if the exchange rate has fluctuated.

A capital gain or loss is also realized when the funds are used to purchase securities that trade in the foreign currency, or when the funds are used to pay expenses or make a purchase. In these cases a deemed disposition of the foreign funds is considered to have occurred, even though they may not have been converted into Canadian dollars.

Special attention must be made when holding foreign currency in a foreign currency bank account or brokerage account. A conversion of Canadian dollars into a foreign currency will increase the ACB of the foreign funds by the value in Canadian dollars. Similarly, if you receive foreign funds directly (for example: income, dividends, interest), the value in Canadian dollars is added to the ACB of the foreign funds. This will affect the amount of the capital gain or loss when the foreign funds are eventually converted to Canadian dollars or spent (although the income, dividends, and interest will likely be taxable immediately).

If you hold a foreign currency in multiple accounts, do not calculate ACB separately for each account. ACB must be jointly since the same currency is considered an identical security (see Tracking Adjusted Cost Base with Multiple Brokerage Accounts).

The CRA provides a $200 exclusion on foreign exchange gains. If the gain on foreign currency is less than $200 for the year, you do not need to report it. Also, any loss less than $200 cannot be claimed. This was put in place so that taxpayers are not overburdened by the complexity of tracking ACB for foreign currency used casually such as for traveling. But when gains exceed $200 the calculations can become quite cumbersome.

For example, suppose you convert CAD$100,000 into U.S. dollars with an exchange rate of CAD$1=USD$0.9192. The U.S. cash balance becomes:

CAD$100,000 x USD$0.9192/CAD$ = USD$91,920

Since ACB is tracked in Canadian dollars, the initial ACB is simply CAD$100,000.

Next, suppose the funds earn interest of USD$80 when the exchange rate is CAD$1=USD$0.9304. The interest would be immediately taxable in the current tax year. The ACB of the U.S. dollars increases by USD$80 converted into Canadian dollars. The ACB increases to:

CAD$100,000 + (USD$80.00 / USD$0.9304/CAD$) = CAD$100,000 + CAD$85.98 = CAD$100,085.98

The account balance is now USD$92,000.

Then, suppose you spend USD$1,200 on a vacation funded directly from your U.S. dollar account, when the exchange rate is CAD$1=USD$0.9023. This results in a deemed disposition of the U.S. dollars even though no conversion to Canadian dollars took place. The proceeds in Canadian dollars are:

USD$1,200 / (USD$0.9023/CAD$) = CAD$1,329.93

A capital gain has occurred and must be reported on your tax return. The capital gain is equal to:

CAD$1,329.93 — (CAD$100,085.98 x (USD$1,200.00 / USD$92,000.00)) = CAD$1,329.93 — CAD$1,305.47 = CAD$24.46

The new ACB is:

CAD$100,085.98 — (CAD$100,085.98 x (USD$1,200.00 / USD$92,000.00)) = CAD$100,085.98 — CAD$1,305.47 = CAD$98,780.51

and the U.S. cash balance is USD$90,800.

Next, you convert USD$1,000 into Euros when the exchange rates are CAD$1=USD$0.9409 and USD$1=EUR€0.7234 (and therefore CAD$1=EUR€0.6806). The U.S. cash balance is now USD$89,800 (USD$90,800 — USD$1,000). The USD$1,000 is deemed to have been sold so this results in the following capital gain:

(USD$1,000.00 / (USD$0.9409 / CAD$)) — (CAD$98,780.51 x (USD$1,000.00 / USD$90,800.00)) = CAD$1,062.81 — CAD$1,087.89 = —CAD$25.08

The capital loss of CAD$25.08 can be applied to offset capital gains. The new ACB for the U.S. dollars becomes:

CAD$98,780.51 — (CAD$98,780.51 x (USD$1,000.00 / USD$90,800.00)) = CAD$98,780.51 — CAD$1,087.89 = CAD$97,692.62

Assuming that you don’t spend the Euros immediately, you must now track the ACB for this new holding. The initial Euro cash balance is:

USD$1,000.00 x (EUR€0.7234/USD$) = EUR€723.40

The initial ACB for the Euros becomes:

EUR€723.40 / (EUR€0.6806/CAD$) = CAD$1,062.89

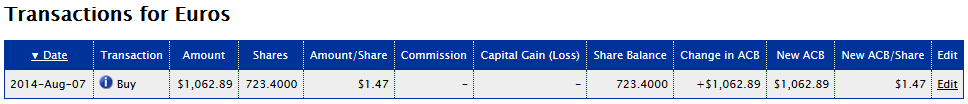

The ACB for Euros must now be tracked separately.

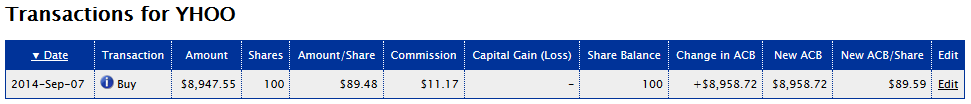

Finally, you purchase 100 shares of YHOO for USD$80.00 per share with a commission of USD$9.99 and an exchange rate of CAD$1=USD$0.8941, funded directly from your U.S. dollar account (see Calculating Adjusted Cost Base when Purchasing Foreign Currency Securities). This results in a deemed disposition of U.S. dollars in the amount of:

(100 shares x USD$80.00/share) + USD$9.99 = USD$8,009.99

This results in the following capital gain:

(USD$8,009.99 / USD$0.8941/CAD$) — (CAD$97,692.62 x (USD$8,009.99 / USD$89,800.00)) = CAD$8,958.72 — CAD$8,714.00 = CAD$244.72

The ACB of the U.S. dollar is now:

CAD$97,692.62 — (CAD$97,692.62 x (USD$8,009.99 / USD$89,800.00)) = CAD$97,692.62 — CAD$8,714.00 = CAD$88,978.62

And the U.S. cash balance becomes:

USD$89,800.00 — USD$8,009.99 = USD$81,790.01

Finally, the ACB of YHOO must also be calculated in Canadian dollars:

USD$8,009.99 / (USD$0.8941/CAD$) = CAD$8,958.72

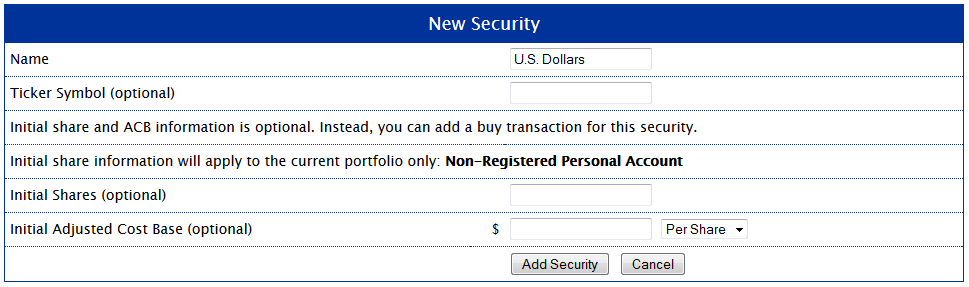

AdjustedCostBase.ca can be used for calculating ACB and capital gains on foreign currency balances. To do so, create a new security for each foreign currency as follows:

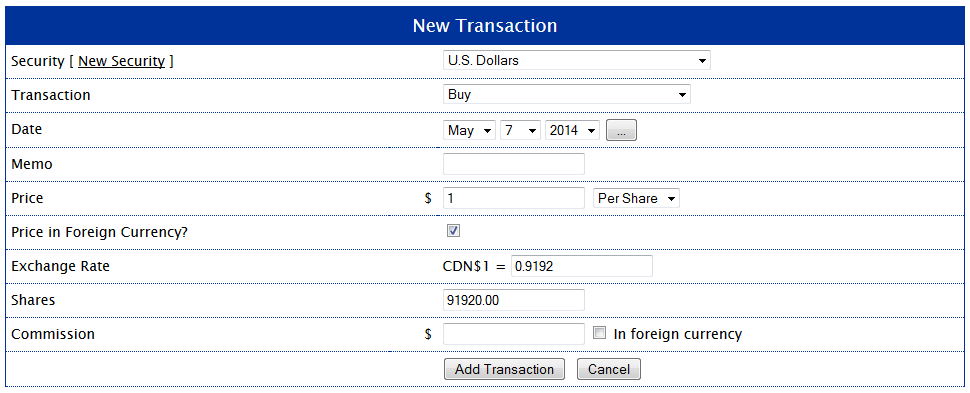

Each transaction can be inputted as a buy or sell transaction for U.S. dollars. Here is the first transaction from the example above:

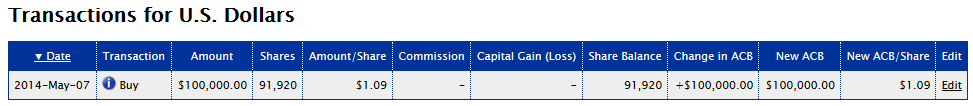

This is a buy transaction because U.S. dollars are being purchased. The price can be entered as $1.00 indicating that each unit (or “share”) is equivalent to USD$1.00. For all transactions on U.S. dollars, use $1.00 as the price, since one unit of currency will always be worth USD$1.00. The “Price in Foreign Currency” checkbox is checked, and the exchange rate is entered. This results in the following transaction:

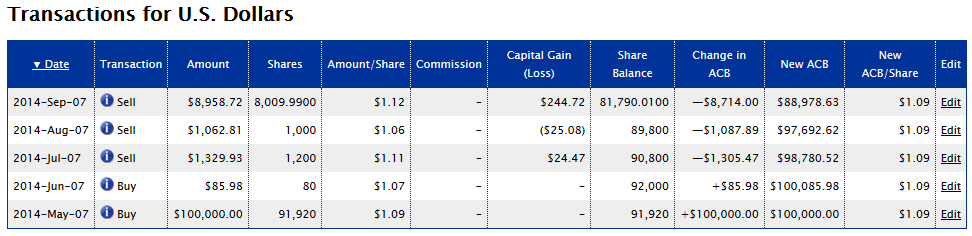

Note that the ACB is CAD$100,000 as expected. All values in the transaction list are shown in Canadian dollars. The remaining transactions can be entered in a similar fashion. For the purchase of Euros two transactions must be inputted: a sell transaction for U.S. dollars and a buy transaction for Euros. Similarly, for the purchase of YHOO you must enter two transactions: a sell transaction for U.S. dollars and a buy transaction for YHOO.

Below are the list of transactions for the entire example:

Excellent write up! Finally an article that clearly explains detailed FX calculation.

Particularly, once you already have foreign currency and there is an appreciation in the FX rate before you purchase a foreign stock, there is a deemed disposition of the foreign currency when you purchase the stock.

In my taxable US dollar account with a Canadian brokerage, I often move cash in and out of a high interest savings account at a bank such as TDB8152 which trades at a price of $10.

Am I correct that this is still considered US cash (the same capital property) and that simply moving the money between the brokerage and the bank fund does not constitute a capital transaction?

If so, the calculation and reporting of ACB gets weird because sometimes the cash has a price of $1 and sometimes $10. What’s the best way to report these US cash transactions so that CRA won’t see a conflict between my tax filing and the information the brokerage submits to them?

RG,

I’m not completely sure about this situation so it may be best to consult the CRA or a tax professional.

However, I can see reasonable arguments for either case when redeeming units of a U.S. dollar savings mutual fund such as TDB8152 and keeping the proceeds in U.S. dollars. On the one hand, this mutual fund behaves just like a U.S. dollar savings account at a bank. When transferring U.S. cash from one savings account to another without any currency conversion, no deemed disposition would occur. On the other hand, TDB8152 is technically a mutual fund, so an argument can be made that selling units is considered a disposition. When you sell an index fund and purchase another index fund tracking the same index, a deemed disposition has occurred, even though the underlying holdings remain the same or similar. Similarly, if you sell a fund that contains a combination of cash and other securities, you would not be eligible to avoid capital gains on the cash portion.

If the amount of potential capital gains is relatively small, I would suggest tracking the ACB of TDB8152 separately to avoid any trouble. This is especially true if you expect to deploy the U.S. dollars shortly after selling. Just be careful about capital losses – in this case the superficial loss rule would likely apply.

If you wish to track ACB for cash and TDB8152 together, I would suggest denominating everything in units of one U.S. dollar. For transactions involving TDB8152, you can multiply the number of units by 10.

Thanks, I appreciate your thoughts on this. As you suggested, I did some further checking. I found the follow statements on the TD Asset Management web site concerning the TDB8150 product series.

Product name: TD Investment Savings Account

Investment Type: Deposit of a Canadian bank

Additional Information: The TD Investment Savings Account is a deposit and not a mutual fund. It is not issued by prospectus. Transactions in this product may appear on a client broker dealer statement under the industry standard “Mutual Fund” heading.

I contacted CRA with this information and spoke to an agent who said he could answer questions about reporting gains on foreign currency transactions. After disappearing for a few minutes of research and checking with some colleagues, he responded that movement of cash to/from the savings account would not be a reportable transaction (unless it happened to coincide with another transaction, such as the purchase of a security, that was reportable). I posed a scenario where I held US cash for 45 days between selling one security and buying another, and moved the money into the TD savings product for 30 of the 45 days. He confirmed that I should report the gain/loss once for the 45-day period.

So, this means I won’t need to track buy/sell transactions on TDB8152 since the actual purchase/sale of USD will be recorded at other times. However, when I record interest payments from TDB8152 as US currency purchases, I plan to use the method you proposed by using units of $1 instead of $10.

RG,

Thanks for sharing this very useful information!

Hi,

Just want to clarify for myself. Couple of times I received US$ as a gift from my parents (they live in another country). One time i did deposit this amount directly at the branch into my US$ account and other time i did transfer from my account in foreign country into my US$ account at Canadian bank. Both transactions were made at the time when Can$ vs. US$ was around a par. So if i decide to go on vacation and withdrew lets say US$ 5000 at current rate 1Can = 0.80US, will i have to declare capital gain? I never executed conversion and intending to spend those US$ funds on my vacations, purchasing online paying directly in US$ etc.

Thanks in advance,

Regards,

Ana

Ana,

If you spend foreign funds directly without first doing a conversion, a deemed disposition will still occur. This can indeed trigger a capital gain/loss.

Pingback: Taxable Consequences of Norbert’s Gambit | Canadian Couch Potato

Suppose you only have US dollars from the start and buy a US stock. Then later you sell it and the exchange rate to the Canadian dollar changes alot but you don’t convert the US dollars to Canadian. Then do you end up paying capital gains tax on the foreign exchange even though you didn’t exchange any currency? This could be quite expensive or do you just report the capital gain due to the stock going up and remove the amount of the foreign exchange?

So even if you do not convert US dollars to Canadian after selling a US stock bought in US dollars, and the Canadian dollar depreciates significantly from your purchase date, you will have to pay capital gains tax on a “phantom” gain due to this currency exchange even if you leave your profits in US dollars?

Bill,

ACB should always be tracked in Canadian dollars, and foreign currency is treated similarly to any other investment such as stocks. When you purchase US stocks with US cash, a deemed disposition of the US cash occurs which results in a capital gain or loss. When you later sell the stocks, your gain or loss is calculated based on the value of the proceeds in Canadian dollars, even if the proceeds are not converted back into Canadian dollars (and in this case it would be as though you simultaneously purchased US cash, which would add to your ACB of US cash, even though no foreign currency conversion has taken place).

In other words, when you buy US stocks with US cash, it’s treated as if you’ve converted your US cash to Canadian and then purchased the US stocks with Canadian cash. And when you sell US stocks and receive US cash, it’s treated as if you’ve received Canadian cash and instantaneously converted it into US cash.

Hi,

What if I borrow USD to purchase USD stocks? I am wondering if I need to keep track of the ACB of the negative USD balance and if it’ll trigger gain or loss by borrow more and repaying the USD.

Thanks

Superb write up.

How about if I stock up US$ by converting from C$ in year 1 and use the US$ fund to buy a US stock. In year 2, the US$ & stock price increased significantly. I sold the US stock, realizing stock price gain but keeping the proceeds (in US$ cash) on account (non-registered) for buying US stock or in anticipation of forex gain (by converting back to C$) in future years? Can I consider the disposition of not yet happened and CRA doesn’t require me to file tax on the unrealized forex gain? How would the tax treatment when I buy a US stock with the proceeds says in year 3?

Thanks!

Ryan,

You’ll be required to report a capital gain by calculating the proceeds in Canadian dollars, which means that the capital gain will be based on both the appreciation of the stock and the US dollar. Let’s say that you engage in the following transactions as you’ve described:

1) Buy US dollars (convert from Canadian dollars)

2) Buy US shares with US dollars

3) Sell US shares and receive proceeds in US dollars

These transactions would be equivalent to the following for tax purposes:

1) Buy US dollars (convert from Canadian dollars)

2a) Sell US dollars (convert to Canadian dollars)

2b) Buy US shares (using Canadian dollars from 2a)

3a) Sell US shares and receive proceeds in Canadian dollars

3b) Buy US dollars (using Canadian dollars from 3a)

Even though the explicit currency conversions in 2a and 3a may not have actually occurred, this is how it works for tax purposes. A capital gain or loss will apply for 2a and 3a.

Thanks!! Should the BOC exchange rate at noon on trade date has to to be used? My brokerage has a big spread between buy & sell & It will be fair to use its rate, not the BOC one. Do yo think if it is acceptable to CRA?

A further question about the disposition of the proceeds (US$ cash) that didn’t actually happened in year 2 but capital gains (forex) tax was reported and paid. When the disposition of the proceeds actually happened (spent it) in year 4 in the future & the exchange rate increased further above the one on the trade date when I sold the stock in year 2, do I need to report capital gain to CRA in year 4? I would be tempted to think that I paid the capital gain tax to CRA in year 2 & that’s it.

You can use the actual exchange rate from the conversion (which would be advantageous due to the spread).

Spending foreign currency results in a deemed disposition of the foreign currency, so a capital gain may apply.

Cloud,

According to IT-95R (http://www.cra-arc.gc.ca/E/pub/tp/it95r/it95r-e.html): “determining the income tax status of foreign exchange gains or losses is the identification of the transactions from which they resulted, or, in the case of funds borrowed in a foreign currency, the use of the funds.”

So if you borrow US dollars and invest the borrowed funds in shares and the transactions for the shares are on capital account, then any gain or loss resulting from borrowing US dollars would be considered as part of your total gain or loss. For an example please see the following:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/#comment-81348

Excellent write-up. I’m pretty sure I know the answer to this but thought I’d ask.

If I have a US brokerage account and I trade US stocks in there, do I still need the ACB in Canadian dollars? (aka, as long as i’m a canadian citizen, do I need to ACB in Canadian dollars regardless of where the account is or what the account is)

Hi Jason,

Yes, you would need to track the ACB of stocks held in a US brokerage account in Canadian dollars.

Great article!

We are new immigrants and came to Canada with our US dollars earned before we arrived. We have kept them in a US dollar account in Canada. When we arrived the dollar was close to par with the CAD. Currently the CAD:US = 0.77

Would we liable for capital gains tax :

1. On US dollar expenditures from our US dollar account when abroad – holidays for example?

2. The moment we invest same US dollars in stock quoted on US stock markets?

Thanks!

we are considering selling our vacation house in the US. We are Canadians. With the current exchange rate, we will be realizing several thousands of dollars when converting the money from U

S to Canadian…….do we pay tax on that money generated by the current exchange rate in Canada?

Thanks for this great article. I am confused about one point. In the example of the Yahoo transaction (purchase of a security within the USD account), you use the current market exchange rate for calculating the FOREX ACB and capital gain/loss, as well for the calculation of the ACB of the Yahoo shares. I would have thought the calculation of the ACB of the Yahoo shares would use the internally generated exchange rate of the US cash account. Thanks for your comment

Ray,

I cases where you have converted CAD to USD to make a purchase, I would suggest using the actual exchange rate. But there are some cases where only a deemed disposition of foreign currency occurs and an actual exchange rate is not available so you’d need to look up the rate (for example, when you purchase USD shares with USD).

M. Lymburner,

If you immediately convert the USD cash to CAD after receiving the proceeds then there may be little or no capital gain/loss on the USD cash. However, there will be a capital gain or loss realized on the property. Note that there are many other tax considerations on the sale of foreign property, aside from capital gains.

A long running US Dollar GIC (renwed often) of money brought from the USA (years ago) and added to by dividends from US stock holdings and interest gains was partially converted and reinvested as Cdn dollar GIC due to favorable exchange rate.

How to determine the adjusted cost base? The money going into the account and interest had tax paid on it.

Long Term Confusion,

A USD GIC is considered to be funds on deposit and thus the ACB is calculated as USD cash (and your ACB is maintained jointly with any other USD cash you own). No disposition occurs at maturity unless or until the funds are converted to another currency, or used to purchase a negotiable investment or other asset. Your ACB for USD cash should also be adjusted for any interest payments for the GIC.

http://www.cra-arc.gc.ca/E/pub/tp/it95r/it95r-e.html

“Foreign currency funds on deposit are not considered to be disposed of until they are converted into another currency or are used to purchase a negotiable instrument or some other asset, i.e. foreign funds on deposit may be moved from one form of deposit to another as long as such funds can continue to be viewed as “on deposit”. Term deposits, guaranteed investment certificates and other similar deposits which are in fact not negotiable, are considered funds on deposit.”

[This comment has been amended for corrections.]

Just to clarify. When YAHOO is finally sold, I assume we have to enter 2 transactions as well

1/ A sell transaction for YAHOO

2/ A buy transaction for USD?

I would assume the logical transactions should be

1/ a sell transaction for YAHOO in USD

2/ for ACB purpose, the USD must be converted to CAD (even though no actual transaction occurred). Therefor it is a SELL transaction in USD to CAD

Jason,

I’ll assume you mean that you’ve sold YHOO and keep the proceeds in USD (not converting into CAD). In this case the following transactions would occur:

1) Sell YHOO

2) Buy USD

I’m a Canadian citizen who works for a U.S company based in Canada . They offer a international stock purchase plan in which they match up to 5% when purchasing company stock…at the time of purchase we op to pay the tax on the company match…My question is.. if i cash that stock and move it into a U.S bank account and then use that money to travel and spend in the U.S.. do i have to pay capital gains on it

Dave,

Spending U.S. cash results in a deemed disposition, so there would potentially be a capital gain or loss (subject to the $200 exemption).

make sense. How about the monthly fee like stock data fee, which doesn’t have corresponding buy/sell of stock. I would assume they’re expense and is used to reduce any profit you make. If the monthly fee is in CAD, I would assume it is best to have a CAD security.

With that in mind, don’t you think we have to keep track of the CAD as such

1/ sell Yahoo, record the ACB in Canada dollar. One entry in adjustcostbase.ca

2/ buy USD using the amount in #1. one entry in adjustcosbase.ca. The exchange rate is the same as #1.

3/ every month, record the monthly fee as commission. enter 0 shares and 0 price and use Security name CAD. exchange rate is 1. Record the FEE as a LOSS in profit and loss

4/ if the monthly fee is in USD, enter 0 shares and 0 price and the usd exchange rate and the fee amount as commission. Record the FEE as a LOSS (in CAD) in profit and loss.

Jason,

I would agree with the first two transactions. However, I don’t think that data fees can be factored into ACB (unless you’re talking about exchange or ECN fees). A data subscription is not directly related to the purchase or sale of a specific stock.

The CRA does permit some investing related fees to be deducted from income:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns206-236/221/menu-eng.html

I’m not sure whether a data subscription fee would be considered deductible, but my suspicion is that it would not be.

I agree that data fees should not be incurred after doing some more research on this.

How about doing a transfer of investment account from one firm to another, I think we can include that as a fee. How do u enter that in the adjustcostbase.ca?

Thanks.

Jason,

Transfer fees cannot be added to adjusted cost base. But these fees may be deductible as “Carrying charges and interest expenses” on line 221 of your tax return.

interesting, when I read about what is allowed under Carrying charges and interest expenses, there is nothing mentioned about the transfer fee and its related HST charges.

Are they considered carrying charges?

Jason,

I believe that these fees would qualify as “fees to manage or take care of your investments.”

CRA allows one to use daily, monthly or yearly exchange to calculate ACB. Is that true?

It also note you must use the same type throughout the year.

Does that mean I can use monthly for one year and then switch to yearly for another year in order to minimize the tax?

In that case of yearly exchange rate, it may seem beneficial for 2015 (2016 may be even better) as we only use one rate throughout the year, it may reduce the USD gain.

Any comment?

Jason,

The CRA unfortunately, is not complete clear on this, and in fact is even contradictory.

Throughout the CRA’s web site, they indicate that an average annual exchange rate can be used for reporting capital gains:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/rprtng-ncm/lns101-170/127/clc-rprt/menu-eng.html

However, the CRA has contradicted itself by releasing the following statement (that appears to only be available in French):

https://translate.google.ca/translate?hl=en&sl=fr&u=http://www.taxinterpretations.com/content/361423&prev=search

“Key questions: What is the CRA’s position with respect to the use of average foreign exchange rates for the conversion of water equivalent of income and capital gains?”

“Adopted Position: An average rate may be acceptable for items of income, but not for capital gains.”

I have never heard of a monthly rate being recommended for calculating capital gains, so I would suggest sticking with either the daily rate, actual rate, or annual rate.

In general I would recommend using either the actual rate or the daily rate. In cases where an actual exchange has occurred (as opposed to a deemed disposition), I would recommend using the actual rate over the daily rate. This is because the currency conversion spread (the difference between what you pay to buy and sell currency) will reduce capital gains slightly. I would also recommend being consistent with your choice.

reportable items re: Foreign Currency Cash

This query pertains to Jason’s questions posed Feb. 6, 2016 in regards the effect of “payments” (fees, interest paid, withholding tax) on positive foreign currency cash balances. Would such “payments” (USD for example used or “sold” in such events) be considered taxable events in an account where the foreign currency is transacted primarily in terms of capital purchases/sales? These “payments” are not directly related to any specific capital transaction in the foreign funds. In other words would such foreign cash balance reductions result in possible, deemed, reportable currency gains/losses?

John M.

John,

If a payment of foreign currency isn’t for the purchase of capital property, then there still may be a gain or loss on the foreign currency, because they foreign currency itself may be capital property. For example, if you spend foreign currency on a vacation, there would be a deemed disposition on the foreign currency, even if it’s spent directly without any conversion.

More information about this can be found here:

http://www.cra-arc.gc.ca/E/pub/tp/it95r/it95r-e.html

“The following are examples of the time when the Department considers a transaction resulting in the application of subsection 39(2)…funds in a foreign currency are used to make a purchase or a payment”

If a capital gain in CAD of US securities bought with US dollars (margin or cash) includes an embedded capital gain + an embedded foreign exchange gain or loss , then when the security is sold and funds are left in US account wouldn’t you be double taxed on further conversions of those funds to Canadian dollars since you’ve already paid this “phantom” capital gain (assuming the conversion of currency is at the same exchange rate as when the security was sold). The reason I ask is that it seems the exchange of cash and a prior investment are two separate unlinked transactions for tax purposes.

Peter,

I don’t see this as a double taxation because you’re never taxed twice for currency fluctuation over any given period of time. When you sell the shares the capital gain will be based on the price movement of the shares as well as USD$. If you leave the proceeds as USD$ you won’t incur a capital gain or loss until the USD$ are sold (or deemed to have been sold), and this gain or loss will be based on the fluctuation only after the sale of the shares/deemed purchase of the USD$ (assuming for simplicity that you don’t own any other USD$).

Regarding the double taxation I use this example:

USD:CAD = 1:1 .

Buy US stock for $100 USD ($100 CAD).

USD:CAD = 1.5.

Sell US stock for $200 USD ($300 CAD).

Capital Gain:$100 core gain + $200 forex gain = $300 stock capital gain.

Now you pay tax, let’s say 30% or $100 CAD.

The $200 USD is still sitting in US dollars.

If you now convert $200 USD to CAD (assume exchange is still 1.5) = $300 CAD.

What is the cost basis of these $200 USD? I would say you should pay no tax on the conversion because it was already paid in the investment calculation. But I’m not sure if a portion of this amount is in fact an additional gain.

Peter,

Your calculation for the capital gain on the shares is not correct. The gain is equal to:

(USD$200 x 1.5 CAD$/USD$) – (USD$100 x 1.0 CAD$/USD$)

= CAD$200

For the gain on the USD$ cash, assuming that:

a) You don’t own any other USD$ from the time the shares are sold until 30 days after the conversion to CAD$ (for simplicity, otherwise the ACB calculations would be more complex)

b) The exchange rate is the same at the time the shares are sold as at the time of the USD$ to CAD$ conversion

c) There’s no spread or commission paid to convert from USD$ to CAD$

then the capital gain on the USD$ would be zero. Your ACB for USD$ is CAD$300 (USD$200 x 1.5 CAD$/USD$) when the shares are sold (when the USD$ are deemed to have been acquired), and the proceeds are also CAD$300 at the time of the conversion.

Are GIC transactions – all within the same foreign bank account – recognized by the CRA as separate transactions (as though they occurred in a brokerage account)? Since the GIC’s have the same par value at time of sale and purchase I.e. no risk to principal, could they be considered as cash held in the account, subject only to tax on the interest as and when it is paid?

If they are treated as equities (i.e. separate transactions), then am I correct in the following scenario:

When buying a GIC with foreign funds, two transactions occur: 1) deemed sale of foreign funds to buy the GIC – taxable as capital gain/loss based on ACB of those funds, and 2) buy of the GIC expressed in Canadian funds, which will be relevant upon the redemption of the GIC.

When the GIC matures – (whose principal expressed in the foreign currency has not changed (i.e. 100USD) – then three transactions occur: 1) payment of interest, whose CAD value is immediately taxable, 2) sale of the GIC whose par value when expressed in CAD may have changed due to exchange rates changes, immediately taxable as a capital gain/loss, and 3) a buy transaction of the foreign currency (principal+interest) which is relevant only when it is later spent.

Many thanks for much insight into a challenging topic.

John,

The purchase and maturity of foreign currency/US dollar GIC’s do not result in a deemed disposition of foreign currency, according to IT-95R (when the purchase is funded directly from foreign currency cash and the proceeds are kept in foreign currency cash):

http://www.cra-arc.gc.ca/E/pub/tp/it95r/it95r-e.html

“Foreign currency funds on deposit are not considered to be disposed of until they are converted into another currency or are used to purchase a negotiable instrument or some other asset, i.e. foreign funds on deposit may be moved from one form of deposit to another as long as such funds can continue to be viewed as “on deposit”. Term deposits, guaranteed investment certificates and other similar deposits which are in fact not negotiable, are considered funds on deposit.”

If you are converting from USD to CAD from a pool of capital, should you use LIFO, FIFO, or avg ACB for calculating gain/loss? Also, if a transaction converts from CAD to USD, then USD to CAD, then back from CAD to USD, is the last transaction an unrealized gain/loss or does it change the ACB of the pool?

Peter,

In Canada, the CRA requires ACB calculations for transactions on capital account. While LIFO, FIFO or other methods may be applicable in other countries such as the US, they does not apply here.

The last transaction (a conversion from CAD to USD, or a purchase of USD) does not result in a gain or loss of any kind. It has the effect of increasing ACB.

Thanks. So it sounds like there is not even the issue of mixed funds like in the UK. All accounts are aggregated together even if US to CAD conversions occurred from one account one must consider the ACB for that transaction including funds from separate accounts?

Peter,

Yes – ACB is calculated based on the notion of identical property. It’s not relevant whether it’s held in the same account or separate account: all identical property is pooled together for the purpose of calculating ACB.

Thank you, one last question that confuses me a bit. There was an answer prior about how to calculate ACB and capital gain in CAD for a transaction in USD that was using a margin loan. I have never heard of deducing a forex gain/ loss for the loan portion from the forex gain/loss from the sale proceeds. Always either the capital gain was calculated correctly on a T5008 with box 20 and 21 filled in by the broker (even if you used a margin loan) or you just calculate the buy transaction in CAD on a gross basis and then subtracted the sale proceeds converted in CAD on a gross basis. Or was that discussion if the loan was in a different currency than the stock purchased?

Peter,

I believe the discussion you’re referencing relates to purchasing US shares on a US margin account. If you purchase either Canadian or foreign shares with a CAD$ margin account (I’m assuming this is what you’re referring to) then there is not foreign exchange gain or loss on the loan amount.

If my wife and I hold investments in USD accounts, then I’m assuming that both of us should track the ACB of our USD cash since we have to pay taxes on the capital gains on an individual basis. Now my question is, what happens when my wife records a loss and within 30 days I report a gain on a USD transaction. Would the Superficial Loss rule apply for my wife’s transaction (she could not claim the loss) or would this rule only apply for the end of year gain/loss or not at all. It seems to me that things would get really complicated if this rule would apply for every little transaction during the year.

Hope you can shed some light on this.

Max,

I don’t know of any exemption rules for the superficial loss rule for foreign currency. However, the superficial loss rule isn’t triggered by another sale – it’s triggered by another acquisition (within the 61-day window centered around the sale) and when you still own the property 30 days later. For more information please see the following:

http://www.adjustedcostbase.ca/blog/what-is-the-superficial-loss-rule/

So what you are saying is that the superficial loss rule would be triggered if my wife bought shares using her USD cash (selling USD) that would result in a USD capital loss (if ACB is higher than the current USD value) and within the 61 day window I would sell shares and receive USD (buying USD) and still own the shares 30 days after my wife bought the shares. The superficial loss rule would even apply if I just received dividends on any of my US holdings (which is equivalent to buying USD). This would almost mean that the superficial loss rule would always apply either for myself or my wife since we both hold dividend paying US securities in our accounts. The rule could even be triggered for both of us at the same time if we were actively trading shares in which case it could get quite difficult to track everything properly.

Is all this correct or am I misunderstanding something.

Would this formula be accurate? CAD gain on investment (with implied forex) + cash movement forex gain/loss / margin loan gain/loss? However the loan is attached to the investment and usually does not move except the incremental change from the cash transactions.

Hi thanks for this great blog.

I got a question on ESPP purchase with some discount in USD.(I am a Canadian)

Scenario:

We contribute toward ESPP from each payroll and then on 6/30 & 12/30 of each year, those contributed CDN funds are converted into USD, and purchase the shares at the lower price of 85% of the current market price, or the price at the beginning of the offer. The 15% of the difference are treated as income and taxed immediately.

So let’s say, I have the following transactions:

12/30/2012: contribution in CDN5687.78, CDN1 = USD1.008319; buy 46 shares at unit price U$128.56; Market price U$151.25

6/30/2013: contribution in CDN5863.26, CDN1 = USD0.9710; buy 70 shares at unit price U$81.28; market price U$95.63

…

several sale transactions in 2015 and withdrawing some USD to for vacation expenses.

My questions:

1. If I transfer the shares from one institution(E-Trade in USA) to another institution(RBC Direct Investing in Canada). Will it trigger capital gain/loss?

2. Since the 15% of the difference was taxed as income, the ACB should be calculated based on market price of each purchase, not the real purchase price, is this correct?

3. I get the idea that USD and the stock need to be tracked seprately. But on the USD, which should be used as the cost for each purchase? The nominal vaule, or the market value. Eg, on 12/30/2012, what is the cost base for USD? 46 * 128.56 / 1.008319, or 46 * 151.25 / 1.008319? If we use 128.56, and assume this is the only purchase transaction and we sell immediately on that day at market price, we get 46 * 151.25 / 1.008319 back, so the gain is 46 * (151.25 – 128.56) / 1.008319, which is the 15% difference and already taxed as income. I think we should use the market value as cost base, is this correct?

4. If I keep ACB of the stock in USD(for various purchases), and at the time of sale, convert the gain into CDN using the current rate, it seems that I get a much smaller gain than keeping ACB in CDN. But as per this blog, we must keep ACB in CDN, which seems to be making a big difference on gain due to the exchange rate fluctuation.

Thanks!

Max,

Yes, that sounds correct. However, the losses won’t disappear forever as they can be added back to ACB, so this has the effect of reducing capital gains when they eventually occur.

Hunter,

1. There’s no deemed disposition for transferring property between financial institutions as long as nothing is sold, so there should be no capital gain or loss.

2. The ACB should most likely be equal to the cost of the shares, plus the taxable benefit, which should equal the fair market value.

3. You haven’t mentioned any transactions involving US cash in your example, so it doesn’t look like it needs to be tracked here.

4. You shouldn’t track ACB in USD$. ACB always needs to be tracked in CAD$. Please refer to the examples above and at http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/.

Hi, thank you for your detailed posts and generous help!

When calculating ACB for foreign currencies, how should I compute dividends paid? I have the following scenario:

Suppose a stock I am holding in a USD investment account pays USD $50.00 in cash as a quarterly dividend, of which USD $7.50 is withhold tax, so the actual amount added to the account is USD $42.50. If the exchange rate is 1 USD = 1.35 CAD when the dividend is issued, does the USD ACB increase by ($42.50 * 1.35) = $57.38? How can I use the website to record this transaction?

Daniel,

You got it. It can be entered as a buy transaction for USD$ for 42.50 shares with a price of CAD$1.35.

Hi there,

If I have purchased 100 share xyz for 60USD, and commission is 10USD. The transaction went through from my Canadian account, and currency was 1USD=1.37CAD. Then sold 50 shares for 50 shares for 62USD, and transfer 500USD to my USD bank account, and then transfer this 500USD to my CAD bank account. How should I calculate this capital gain?

Thanks,

Wendy

Wendy,

That would involve the following transactions:

1. Purchase 100 shares of XYZ for ((USD$60/share x 100 shares) + USD$10) x CAD$1.37/USD$

2. Sell 50 shares of XYZ for (USD$62/share x 50 shares) x [the exchange rate]

3. Buy (USD$62/share x 50 shares) of USD$ for (USD$62/share x 50 shares) x [the exchange rate]

4. Sell USD$500 for USD$500 x [the exchange rate]

Hi,

Would a purchase made in foreign currency with a foreign credit card trigger the superficial loss rule even if no cash withdrawals were made to pay off the card balance within 30 days?

Thanks.

Hi there,

Thanks for your respond.

Another question, let’s make it this way:

If I have purchased 100 share xyz for 60USD, and commission is 10USD. The transaction went through from my Canadian account, and currency was 1USD=1.37CAD. Then sold 50 shares for 50 shares for 62USD, exchange rate 1USD=1.32CAD. I kept the USD in the USD savings account until after 6 months.

1. Purchase 100 shares of XYZ for ((USD$60/share x 100 shares) + USD$10) x CAD$1.37/USD$

ACB=6010*1.37=8233.7 ACB PER SHARE=6010/100*1.37=82.337

2. Sell 50 shares of XYZ for (USD$62/share x 50 shares) x 1.3

ACB={6010-(50*60.1)}*1.32=3966.6 ACB PER SHARE=3966.6/50=79.332

Sell amount=(50*62-10)*1.32=3090USD.

capital gain=3090*1.32-3966.6=112.2

However, after the sell, I kept this sell amount 3090USD in my USD savings account, and didn’t transfer it to CAD after 6 month. After 6 month, I transfer the 3090 USD dollar into my CAD savings account, and the currency is 1USD=1.28CAD. What’s my ACB under this condition? And how should I report this? Should I report the capital gain/loss when I sold the stock or when I transfer the USD currency into CAD currency??

Thanks,

Wendy

Wendy, what if you NEVER convert back the $3090 to CAD savings account? Does this mean you will have paid tax on a gain/loss that never has occurred and might never occur?

Hi there,

Does that mean I need to report 2 capital gain/loss transaction? One is when I sold the stock? and one is when I transfer $3090 USD back to CAD savings account?

Thanks,

Wendy

Just speculating but I don’t think the government will allow you to do this – they want their money NOW. Probably you report an unrealized gain as a realized gain and if the currency goes against you in a future year, you claim that as a capital loss? Still, it does seem you are paying gains ahead of realizing them. Is this fair?

Wendy,

In your example, there would be a capital gain or loss when you sell the shares, as well as a gain or loss when you convert the USD into CAD. However, your calculations for ACB are not correct as ACB per share should not change as a result of the sale of the shares (see the examples above).

Peter,

The USD would eventually incur a deemed disposition either on death or when the money is spent, even if the funds are never converted.

I see, so if you keep the money in an investment account and do not spend it but it waits for a new investment, then the capital gain recorded on T5008 form is incorrect because it converts purchase and sale price to CAD from each sale which includes foreign exchange movements even if there was no conversion to CAD or even if the funds were not spent?

Peter,

All values should be converted into CAD when computing capital gains, so it sounds like your document could be correct, however, I can’t comment further about something I haven’t seen. Note that the calculation of a capital gain on a USD security is the same regardless of whether the proceeds are received in CAD or USD. If the proceeds are received in USD, then in the case there will be a an additional gain or loss at the time of deemed disposition.

Thank you, that makes sense. However I notice loss carryback can only be used to offset capital gains 3 years back, so if the deemed disposition happens after 3 years, I assume the foreign exchange loss (if it should occur after 3 years) will not be able to offset the foreign exchange gain that was paid more than 3 years prior when US funds are not spent?

Peter,

That’s true that capital losses can only be carried back 3 years, but they can be carried forward indefinitely. Also, capital losses can be applied against any other capital gains, not just capital gains on the same type of property.

I see you found the CRA statement that said the average annual exchange rate can NOT be used for capital gains/losses calculations. Which contradicts the CRA website. It’s briefly discussed in this Globe and Mail article too: http://www.theglobeandmail.com/globe-investor/investor-education/calculating-gains-and-losses-on-us-stocks-part-2/article28747713/

Have you heard any more about this? I

The choice of using the either the average annual exchange rate or the daily rates of the transaction dates can make a substantial difference in gains/losses.

For example:

– In February I buy 1000 shares of company X at $1000 US/share, and the exch rate is 1.10. So it costs me $1,100,000 CAD to buy the shares.

– In December I sell all the shares and the share price hasn’t changed, but the exch rate is now 1.30. So I get $1,300,000 CAD from the sale.

Clearly this is a $200,000 CDN capital gain, but if I use the average annual exchange rate (let’s say it was 1.25) when reporting the transactions for taxes, both the purchase and sale would have been $1,250,000. I.e. no capital gain at all. (So I can see why the CRA doesn’t want the annual rate to be used).

On the other hand, let’s say instead that the exchange rate drops over the year and my example above is reversed: I spend $1,300,000 to get the shares and get $1,100,000 from their sale. If I use the average annual rate, there will be no loss to report. So in this case I would choose to use the daily rate, so that I can claim a $200,000 loss. (I.e. in this case the CRA *would* be happy with me using the annual rate!)

This is valid and legal according to the CRA website, but not according to their statement from Oct 2014…

It seems a key issue is the interpretation of the statement re: how to fill out Schedule 3 on the CRA website:

“Use the exchange rate that was in effect on the day of the transaction or, if there were transactions at various times throughout the year, you can use the average annual exchange rate.”

Do they mean transactions for one particular company’s shares? Or various transactions in general? (My guess is they mean transactions for a particular stock. E.g. you are selling off stock ABC in small chunks – using an average exchange rate kind of makes sense in this case). Assuming they mean multiple transactions for one stock, the statement then reads as you CAN NOT use the average rate if you just sell off something in one transaction. E.g. a simple, yet typical example. Let’s say I bought Apple shares 5 years ago. Then I sell them all in 2015 and the exchange rate is 1.3 CAD/USD on the day of settlement. But the average annual rate is 1.2 CAD/USD. It seems pretty clear that I’m not supposed to use the average rate (to try to lower my capital gain). On the other hand… if I had 30 other transactions during the year, for other stocks, and the CRA is saying “you had lots of transactions, you can use the average annual rate for them all”, well that’s what I want to do!

Ultimately, the best way to lower capital gains and increase losses would be to pick and choose between daily rates and the annual average, depending on which works out better in my favour, for every transaction. Somehow I don’t think the CRA would be happy with this. 🙂

Thoughts?

Greg,

I think your points are valid. That comment from the Globe and Mail article refers to the same statement from the CRA mentioned above. However, this appears to be a transcription of a verbal statement made in French from a single CRA employee at a conference (which isn’t published on the CRA’s web site). It also completely contradicts statements in multiple places on the CRA’s web site. As a result, I continue to believe that either method should be acceptable, but I recommend using actual exchange rates.

As you’ve shown, the choice in using average exchange rates vs. daily exchange rates can have a significant impact on capital gains in years where the exchange rate has varied substantially. However, I would suggest that you be consistent with whichever method you choose as opposed to picking the one that works best on an annual basis. The CRA may not be happy if you continually switch methods.

Regardless of the contradicting statement that average annual rates are not allowed, I would recommend using the actual exchange rate. This will factor in the spread on the exchange rate that you pay, which will ultimately reduce your capital gains or increase your capital losses. This is true no matter which direction the exchange rate goes, whereas using an average annual rate will benefit you in some years but harm you in others.

I’m not sure whether there’s a requirement of multiple transactions overall or multiple transactions on a single security to use the average rate.

I’m sure taxpayers would greatly appreciate if the CRA would clearly document these rules, but alas, that doesn’t seem to be the CRA’s style.

I thought the rule was you can use one method or the other, but cannot switch once you’ve chosen one way. I interpret this to mean that if I choose one way and did it for years like that, it would be alright to change the method but I would have to use the new method for some reasonable amount of time (maybe one switch per lifetime??)

Also, my broker produces T5008 with cost basis included and the gain is calculated using actual date of transaction, I feel a bit weary to use numbers that will be different than the T5008.

Thanks for your reply, and good point re: the using the actual rate. In my case I am usually not actually exchanging any currency myself… I’m trading in a US dollar account, and keep the proceeds of US stock sales as US dollars and re-invest in other US stocks. When I initially funded my US account, I should have taken the exchange rate spread into account as part of the ACB of stocks I bought. But I never thought of that, and that was years ago. Plus, that seems hard to document if you transfer CDN funds in, then use some of that for a stock purchase right away, but leave some for months and combine it with another transfer in of CND $… etc..

I agree that using the exchange rates of the dates of the settlements is the safest – because it’s also the most honest. I’ll continue to play it safe and use the those rates… Because of how volatile the exchange rate seems to be these days, I think the CRA will soon need to clarify the rules and they will have to go one method only, and that will be with actual rates. They won’t choose the annual average because it would be too easy to take advantage of.

Peter, my broker does not include any ACB at all on my T5008’s. In your case I would definitely use what the T5008 says (unless it’s incorrect), since the CRA has those and will compare against them. My gut feeling is that, because the rule was written before people had easy access to historical daily exchange rates, the intent of “using the average annual exchange rate” was to help make it easier for people in the case where they had multiple transactions for ONE stock. E.g. They had 1,000 shares of X, and they sold 100 per month for 10 months or whatever… Instead of trying to figure out exchange rates for each transactions, they could use the average. So I do think it is per stock, not either all one method or the other. But that being said, I also think the CRA would not be happy if they noticed different methods being used for different stocks in one tax year. It might raise a red flag and cause an audit, and then who knows what would happen, because the rule is open to interpretation…

I think you can forensically deduce an estimated ACB of CAD funds by looking at total US fund inflows and outflows for the relevant year and adding it up – and in that case since it’s many years ago use the average exchange for the years in question. This way you don’t have to look at every transaction.

I am new to the site, so please bear with me. I used norbert’s gambit to convert approx. $50,000 Cdn to US $ for surgery which I needed to have in New Jersey last year (2015). On 2 different occasions I bought Horizon DLR ETF shares in Cdn Dollars and simultaneously sold an equal amount of shares of Horizon DLR.U ETF in US dollars, with the transaction settling in US Dollars. The broker (bmo) journaled the cdn DLR shares across to the US ledger on settlement day, both sides were bought on the same day and settled on the same day. Since the trade was completed within seconds of each other is their a tax consequence, do I not just report the buy and sell with same effective exchange rate? ie no gain or loss?

Thankyou in advance for your reply.

Robert,

You can incur a gain or loss from Norbert’s Gambit. Although it’s likely to be small, there would be a gain or loss resulting from commissions, any fluctuation in the exchange rate between the time you bought or sold, and any commissions paid.

Taking a concrete example, suppose that you purchased 4,000 units of DLR for CAD$12.50/unit with a commission of CAD$10.00. Your ACB would be (CAD$12.50/unit x 4,000 units) + CAD$10.00, or CAD$50,010.00. The act of journaling should not trigger a deemed disposition as far as I know.

Then, suppose you sell all units of DLR.U for USD$9.95/unit and assume that the exchange rate at the time were CAD$1.245/USD$1.00 with a commission of CAD$10.00. Your proceeds of disposition would be (USD$9.95/unit x 4,000 units x CAD$1.245/USD$1.00) + CAD$10.00, or $49,551.00.

You would therefore incur a capital loss of ($49,551.00 – $50,010.00), or -$459.00.

Also note that there may be an additional gain or loss when you spend the USD$, as spending the foreign currency results in a deemed disposition.

Peter,

Unfortunately I’m not aware of any hard rules (let alone guidelines) about switching between methods.

My daughter has student loans in US dollars from a time when the Canadian dollar was higher. If she pays them off now, does she thereby generate a capital loss? For example, $10,000 borrowed when the dollar was at par would cost approximately $12,500 to pay back today.

There are several rates available per day. I am not sure which ones to use when a Canadian investors trades US securities using a US Dollar account.

1. US Dollar Noon (buy and sell)

2. US Dollar Close (buy and sell)

3. US Dollar High (buy and sell)

4. US Dollar Low (buy and sell)

It would appear to me that the best rate to use for taxation purposes would be the ones that minimize capital gain and maximizes losses, possibly the high and low.

Let’s examine the sell of USD to buy YHOO. This transaction takes place on 2014-09-07. The high and low rates according to the Bank of Canada for this date don’t exist, so let’s pick 2014-09-08 instead:

2014-09-08 USD High (1USD->CAD: 1.0903; 1CAD->USD: 0.9172)

2014-09-08 USD Low (1USD->CAD: 1.0983; 1CAD->USD: 0.9105)

The CRA wants to know the capital gain on selling the USD (back to CAD) when selling USD to buy YHOO. Since we’re in possession of USD, we need to use the 1USD->CAD rate, but should it be the high or the low rate? You probably want the least amount of CAD to minimize the gain, so using the USD High rate of 1.0903 would make sense. Is this correct?

When YHOO is sold (at unspecified date), we are purchasing USD using “YHOO” as the currency. But we are really receiving USD in the account, and if we were to convert this USD amount to Canadian dollars, we would want to use the rate that gives us the least amount of CAD to minimize the capital gain. Again the USD High 1USD->CAD rate of 1.0903 seems to make sense.

What do you think?

Martin,

I would recommend against that. The Income Tax Act specifically references the noon rate in section 261(1). Also, it’s always best to stay consistent.

In cases where an actual currency exchange took place, I would recommend using the actual exchange rate. Odds are that the actual exchange rate is higher than the daily high for purchases and lower than the daily low for sales due to fees and the spread, so you’ll end up minimizing gains.

If a Canadian works in a foreign country and is paid in foreign currency, how is the ACB calculated? Using the annual rate? Or as the pay is received? Or…?

And when the funds are left in the foreign bank, would any interest earned have to be added to the ACB?

My wife received $30,000 US dollars from her mother’s estate in 2012 and converted them to almost $40,000 Canadian dollars in 2015. I suppose there’s capital gains tax to pay, but I can’t even find where to enter it on schedule 3. Where does it go?

Tom,

There isn’t really a proper spot for it. I would suggest including it in section 3 (“Publicly traded shares, mutual fund units, deferral of eligible small business corporation shares, and other shares”).

Just to clarify: “…if you receive foreign funds directly (for example: income, dividends, interest), the value in Canadian dollars is added to the ACB of the foreign funds.” Does this also applies to proceeds from a sale of U.S. securities?

Going on your example above for the Yahoo shares, say you sell the 100 shares for USD$100/share for total proceeds of USD$10,000 (let’s say no commission here). Assume on that date, the exchange rate is 0.8, so therefore the ACB of the U.S. Dollar is now:

CAD$88,978.62 + (USD$10,000 / 0.8)

=CAD$88,978.62 + CAD$12,500.00

=CAD$101,478.62

Additionally, there is a capital gain:

CAD$12,500 – CAD$8,958.72

=3,541.28

Is that correct?

Thanks

Gary,

Yes, that looks correct.

This is a great article, and great information.

and now it’s made me curious. I have old worthless francs left over. if i find a way to dispose of them can i somehow get a tax loss to use against my gain in US$?

François,

I would imagine you would be able to claim a loss, as you can when shares or debt become worthless, although I’m not entirely sure. Note that if you claim a loss, it can be used to offset any capital gain from the past 3 years or in the future.

Hi,

First – thank you very much for creating this site, it has vast amounts of very useful information presented in a very understandable fashion for us commoners! The Q&A section at the bottom of each post also has incredible information.

Second – my question is very personal, but perhaps will be useful for others.

I did my first short sale this year on which I’ve ended up losing money in US$ terms as well as in C$ terms because of the foreign exchange movements. Having said that, I believe that I will need to be reporting a capital gain on my foreign exchange balance. Here is how I am looking at the situation (please consider that I am treating these transactions as capital transactions and not income transactions):

Capital Gains / Losses on Short Sale:

1) Short Sale of 500 SPY @ US$200: I receive US$100,000 in my US$ account (equivalent to C$131,000 based on the BoC noon rate)

2) Covering of the Short Sale of 500 SPY @ US$205: I pay US$102,500 from my US$ account (equivalent to C$132,225)

3) Calculation of my capital gain in this case is C$131,000 – C$132,225 = capital loss of (C$1,225)

Capital Gains / Losses on Foreign Exchange Balance:

1) I start with a balance of US$10,000 at an ACB of C$10,000 (FX parity)

2) The short sale adds US$100,000 in my US$ account (equivalent to C$131,000 based on the BoC noon rate) which brings me to a FX ACB of C$141,000 (US$110,000)

3) The covering of the short sale is considered a deemed disposition (as I am purchasing shares), which lowers my account by US$102,500 (C$ equivalent of C$132,225). This brings me to a US$ balance of US$7,500, but my ACB is of C$9,613.64 which can be obtained through the following mathematical operation: C$141,000 – C$141,000* (US$102,500/US$110,000)

4) Calculation of my capital gain in this case is C$132,225 – C$141,000* (US$102,500/US$110,000) = capital gain of C$838.64

So I will be reporting the following: capital loss of (C$1,225) on the share transaction + capital gain of C$838.64 on the FX transaction for a net loss of (C$386.36)

Am I looking at this the right way?

Thanks so much for your help!

Jeremie,

I don’t think that short sales are typically considered to be on capital account. See http://www.cra-arc.gc.ca/E/pub/tp/it479r/it479r-e.html:

“The gain or loss on the ‘short sale’ of shares is considered to be on income account.”

Also note that when calculating ACB for securities in a foreign currency, the gain/loss on the foreign currency should not be separated from the gain/loss on the price of the security (see http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/). This may work in simple cases, but not in more complex cases involving multiple purchases and sales.

Thanks for the above response.

I am aware of the treatment of short sales to be on the income account, but is this the right way to think about FX gains and losses? I could very much re-write the above example as a long sale with borrow.

In the above, I don’t think that foreign currency was separated when calculating the ACB.

Jeremie,

I’m not sure which specific example you’re referring to, but ACB for securities in a foreign currency should be calculated by first converting all values into Canadian dollars, rather than calculating the gain on the pre-converted amounts and multiplying it by a foreign currency gain.

I don’t know much about the process of calculating a gain or loss on income account.

Hello. It would be helpful (to me) if you were able to extend your example to show how the various balances would be affected in the following scenarios:

– You sell some of your Yahoo shares at a different exchange rate.

– You sell some covered call options on Yahoo. (Would this be the same as your dividend example?)

– You buy (to close) your covered call options.

– You sell some naked put options on some other stock.

– You get a return of capital from a stock in USD$.

Would this be possible?

BT,

Some information about buying stocks denominated in a foreign currency is available here:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/

And details on ACB calculations for stock options are available here:

http://www.adjustedcostbase.ca/blog/adjusted-cost-base-and-capital-gains-for-stock-options/

The method for calculating options on capital account would be the same when denominated in a foreign currency, except all values (share prices and commissions) should be first converted into Canadian dollars.

The sale of naked options is normally considered by the CRA to be on income account. However, the CRA will accept reporting on capital account provided it is done consistently from year to year (see IT-479R: http://www.cra-arc.gc.ca/E/pub/tp/it479r/it479r-e.html).

A distribution from a foreign stock is never considered to be return of capital, even if the foreign country considers the distribution to be as such.

Let’s say I have US$ (bought when 1CDN = 1USD) in my bank regular US$ saving account. Can you tell me will I have to pay tax on capital gain if I do transfer to my US$ RRSP trading account, and what if I do transfer to my US$ TFSA trading account. Will it be still counted as deemed disposition (all transfers at the same bank and no money conversion take place).

Tony,

Yes, transfers into a registered account would result in a deemed disposition.

Hi and thank you for this interesting discussion.

I was wondering if I have to declare capital gains if I buy US$ in January and spend them on vacation next July. In theory, spending my US$ in rental, food and leisure would be considered disposition and so if I spend 5000$ USD I should calculate what the cost in CAD will if I had done the conversion in July and report any gains or losses compared to the value of the purchase in January, right?

Marc,

Yes, spending foreign currency results in a deemed disposition according to IT95R:

“The following are examples of the time when the Department considers a transaction resulting in the application of subsection 39(2)…funds in a foreign currency are used to make a purchase or a payment”

Note that individuals are subject to an exemption – the first $200 of capital gains or losses for a year does not count as a gain or loss.

Great website.

I created a login and used your adjusted cost base tool but ran into an issue immediately. Perhaps you could help me out or tell me if my work around is accurate.

I already figured out my gains and losses through the sales of my us securities so I simply Placed all of my buys and sells of the foreign currency (US dollars) into the adjusted cost base software to see if I had a gain or loss on the currency (I didn’t bother entering the data for the stocks because I already had them figured out).

So, let’s say I bought $50,000 US dollars on April 1 in my marginal account. I used the actual exchange rate I received and followed your example of how to input the data. My first transaction was the purchase of a us equity and I bought $145,000 worth with my $50,000 (obviously borrowing money on margin to make the purchase).

To do this transaction I followed your example. So, I entered the data as if i sold my US dollars to Canadian dollars and bought the stock with the Canadian dollars. On April 14 I then sold the stock so I theoretically bought US dollars.

Upon entering this data it thought I was performing a short sale (even though I was simply borrowing on margin) and it brought my ACB to zero.

My work around was setting the date of the sale of the US dollars on the same date as the purchase even though they were two weeks apart. However, I entered the data for the noontime currency rates on the actual settlement date. This kept the account in the positive so that the software didn’t ever think I was short selling. Would this be ok?

If yes, great.

If not, how do I go about convincing the software that I was not shortselling? Should I not have entered the data for currency independently of my us stocks? Did this cause issues?

Hopefully all of that made sense.

Andrew,

Please see the response to a similar question here:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/#comment-81348

I have some US stocks that pay quarterly dividends. Do I calculate ACB using the full dividend amount and then recalculate ACB treating the withholding tax as deemed disposition?

Hi,

I have the same problem as Andrew. I read the comment you linked to, and while that makes sense from a tax perspective, i.e. a gain/loss on the loan of margin, there doesn’t seem to be any way for the ACB website to record this. As Andrew mentioned, when you ‘sell’ more USD than you have, the site deems it a short sale, puts your cost basis at zero, and shows negative shares.

I recreated the scenario posed by Rihana in the comment you linked to, and I can’t find any way for the site to reflect the $40K forex loss on the borrowed margin.

Do you have any suggestions?

Thanks

Sev,

You could handle this situation on AdjustedCostBase.ca by adding the foreign currency gain (or subtracting the foreign currency loss) from the proceeds of disposition in the sell transaction.

Thanks for the reply.

While you could add/subtract the gain/loss to/from the proceeds for tracking purposes, in doing so you’d have to manually calculate and track said gain/loss.

In Rihana’s example, that’s pretty easy. However, in real life, when using margin on a portfolio, it’s not nearly so clean cut. For example, dipping into margin isn’t really associated with one particular holding. The margin is on the portfolio as a whole, which may contain dozens of different holdings, if not more. You may buy a number of securities on margin, sell securities purchased long before going on margin which then effectively ‘repay’ a portion of the loan, reducing margin, etc.

When using all your own cash, this is fine, as you can enter the corresponding USD disposition along with each buy/sell of a security, and the ACB website will keep a running total of how much USD you have, your ACB, your forex gains, losses, etc.

But when you are in the negative on ACB, it no longer does this, so effectively, any forex gains/losses while using margin are not tracked.

Here’s a quick example which will hopefully demonstrate what I mean:

https://i.imgur.com/shc88AC.png

Notice that when on margin, the website treats it as a short sale, doesn’t track ACB for the transactions after entering margin, and therefore doesn’t keep track of any potential gains or losses in forex.

Is there a different way I should be doing this, or are these magin scenarios simply beyond the scope of this website?

I thank you again for your time. I truly believe you’re doing the Canadian population a great service!

Sev,

AdjustedCostBase.ca does not support calculating capital gains for transactions involving short sales (other then when options are sold to open). According to IT-479R:

http://www.cra-arc.gc.ca/E/pub/tp/it479r/it479r-e.html:

“The gain or loss on the ‘short sale’ of shares is considered to be on income account.”

Furthermore, I’m unclear on what general calculation method could be used for short transactions on capital account, if in fact this were allowable.

IT-95R seems to suggest a special case where foreign currency margin gains and losses can be considered to be on capital account if the funds are used to invest on capital account, but it’s difficult to say if this should apply when the pool of borrowed funds is not associated with a single stock purchase. I would suggest contacting the CRA or a tax professional for clarification.

Also note that IT-479R suggests that one of the factors for securities transactions being considered on income account is whether “security purchases are financed primarily on margin or by some other form of debt.”

Hello,

In my non-registered account, i first convert CAD to USD, pay the broker conversion fee, and then do option trades. All trades are bought and sold in USD.

Using the bank of canada yearly average rate, i have calculated the gain/loss for each option trade in CAD. Below is a sample.

Number Name of fund Year of Acquisition Proceeds of Disposition Adjusted Cost Base Outlays and Expenses (from dispositions) Gain (or loss)

1 EBAY Option 2017 $85.71 $64.96 $6.52 $14.23

Now my question is how do you deal with the CAD/USD part for the actual currency conversions to fund the account.

Looking at your example above, it seems like you need to log each and every transaction. In my case, there have been 14 transactions throughout the year from CAD to USD to fund the account. In addition to this, there have been 88 fully completed option trades (Open/Adjustment if Required/Closing). If each transaction on the specific day needs to be logged, this would results in at least 200 entries for the year which doesn’t seem practical.

The average conversion rate to fund the account was 0.7590 and the bank of canada yearly average rate for 2017 is 0.77006. So there is a few pennies difference. $29,505 of CAD was converted to USD. So since the loonie appreciated, the currency loss would be about $424 however in my mind this is just a theoretical loss. One day when the USD is converted back to CAD, this is when the gain/loss should be dealt with.

Is that correct?

Also if you are using the Bank of Canada yearly average rate, wouldn’t the results wind up the same, instead of logging each individual entry and doing the currency conversions back and forth? Like in your example you are using the daily conversion rate each time, what is the average rate was used for each entry? Wouldn’t that simplify everything?

Thanks, RK

Rahim,

When you sell shares denominated in a foreign currency without converting the proceeds into Canadian dollars, the gain or loss on the underlying currency isn’t just theoretical: you’ll incur a gain or loss that depends on both the fluctuation of the share value as well as the fluctuation of the foreign currency relative to Canadian dollars. Please see the following for some examples:

https://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/

The gain or loss on the shares in these examples would be the same regardless of whether the proceeds are kept in foreign currency or received as Canadian dollars.

It’s possible that in some subset of cases where specific conditions are met that the capital gain can be calculated in foreign currency and then converted into Canadian dollars. However, I would advise against using such a shortcut as any potential simplifications would be negated by the need to carefully consider whether these conditions are met.

HI:

My question is: When I am converting the sale of stocks and am trying to convert US positions to CDN, where do i find the BoC exchange rates to use, and would i use yearly rate for trades/proceeds that occur throughout the year, or if a sale occured in Jan, Mar, June for instance, use a monthly exchange rate or apply the daily rate for that trade occuring on that settlement date? Do you have a link to BoC info i seek for 2017 US rates? Very much appreciated!

Rob

Rob,

The Bank of Canada provides daily exchange rates here:

https://www.bankofcanada.ca/rates/exchange/daily-exchange-rates-lookup/

Note also that AdjustedCostBase.ca Premium subscribers can apply these exchange rates instantly to a transaction on AdjustedCostBase.ca.

The CRA has stated the following:

“Use the exchange rate that was in effect on the day of the transaction or, if there were transactions at various times throughout the year, you can use the average annual exchange rate.”

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/calculating-reporting-your-capital-gains-losses.html

Hi,

On CRA Schedule 3 the fourth column is for “Outlays and expenses (from dispositions)”. When reporting capital gain/losses, is it possible to claim in that column any wire transfer fees incurred during foreign currency conversions executed through online exchange services such as XE Money Transfer?

Thanks.

Greetings,

Great website – congratulations.

My wife and I came back to Canada (in Jan 2017) after 18 years of being non-resident. We came back with most of our cash assets (including stocks) in USD. Could you help with the first transaction for tracking cash – let say $ 100,000 USD on Jan 3rd, 2017 ? I am confused with the CDN>USD vs USD>CDN. We do have a Premium account and I am hoping that it will make it easier :).

Also, we held several Canadian stocks listed in the US in USD via a US based broker. We moved the whole portfolio in Canada with Questrade and switched all the Canadian stocks from US to CND dollars ( a simple swap / book entry done by Questrade). An example of that would be Barrick Gold – our shares of ABX.NYSE got swapped with shares of ABX.TSE. Same quantity and no commission.

If you could comment / help with the above – we would appreciate.

Many thanks and best regards,

Michel

Thank you, Michel!

According to “Tax Guide for Investment Advisors” by John Mott:

“When an individual becomes a resident of Canada, he or she is deemed to acquire all of the property owned at that time (subject to exceptions, such as real property situated in Canada) at a cost equal to the fair market value of the property. This provision establishes opening cost bases for the taxpayer’s property, for the purpose of computing gains and losses on subsequent dispositions.”

On AdjustedCostBase.ca you can add a “Buy” transaction for 100,000 units of USD on Jan. 3, 2017. As an AdjustedCostBase.ca Premium user you may use the exchange rate lookup function to set the exchange rate for that date.

As far as I know, journaling shares from a US exchange to a Canadian exchange does not result in a deemed disposition. So there would be no immediate capital gain/loss or change in ACB.

I have an American held mutual fund that automatically reinvests all of it’s dividends and gains into itself. This means that every year that I don’t touch the account at all, there are 2-3 purchases of shares. This has been happening for several years and now that I’ve sold some of the shares, I need to calculate the Adjusted Base Cost in order to figure out my Capital Gains/Loses for my Canadian taxes.

The mutual fund tracks it’s own Cost Basis and Average Cost Basis/Share (in USD, of course). Can I just convert the Average Cost Basis/Share into Canadian Dollars (using the exchange rate for the day that the last purchase was made) and use that for my Adjusted Cost Base? It seems to me like Average Cost Basis/share is the same thing as the Canadian Adjusted Cost Base/share but I’m a lay person and could be misunderstanding these concepts.

Or do I somehow need to be converting into Canadian Dollars at each sale and somehow compounding for the different in the Canadian Dollar vs USD over time (which I know is something you do every year essentially when you claim your capital gains from investments)?