AdjustedCostBase.ca includes a feature, available to AdjustedCostBase.ca Premium subscribers, for generating an annual report of all capital gains and losses incurred.

This feature is only available to AdjustedCostBase.ca Premium subscribers. The cost of the enhanced service is $49/year. The basic features of AdjustedCostBase.ca remain completely free for Canadian investors.

This report is generated as a PDF file and includes a table listing each realized capital or gain or loss for the year in the same format that the CRA requires for Schedule 3 (Capital Gains or Losses). The table provides a clear and concise summary of realized gains and losses, simplifying the process of completing Schedule 3 when filing your taxes. The report can also simplify the process of entering capital gains when completing your T1 tax return using many popular tax software applications such as SimpleTax, StudioTax, TurboTax, H&R Block, UFile and others.

To access the reports, follow the “View All Transactions” main menu link. Next, follow the “Generate Annual Capital Gains PDF Report”:

Finally, select the year for which you wish to generate the report:

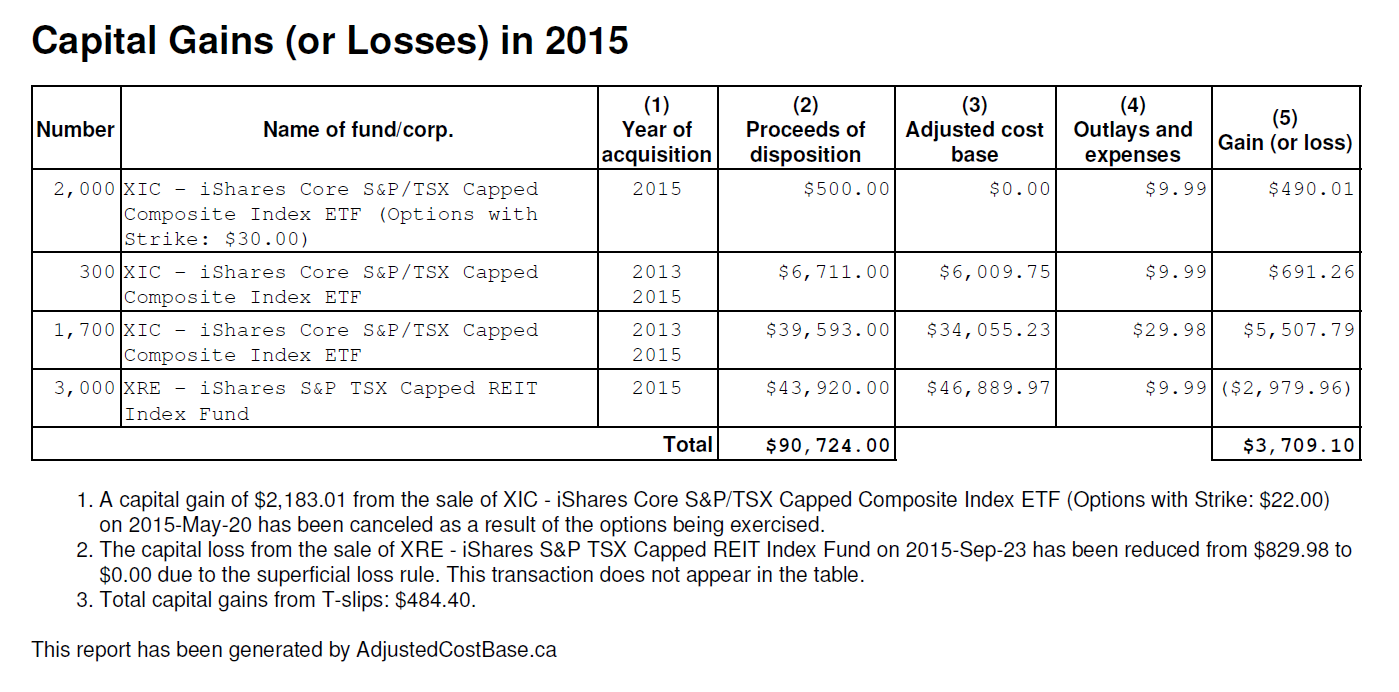

The report will then be generated for you to download as a PDF file. Here’s an example report:

Unlike the full list of transactions on AdjustedCostBase.ca, the table only includes rows for transactions where a capital gain or loss has been realized as a from a disposition. The report also includes each of the columns the CRA requires for completing Schedule 3.

Transactions that do not result in a realized gain or loss – such as purchases, splits and return of capital – are not included in the table.

The table does not include capital gain distributions, which would normally be included on your T-slips, but the total of these values is listed below the table.

Dispositions where a capital loss has been reduced to zero due to the superficial loss rule are not included in the table either, but these transactions are listed in the notes below the table.

The table includes only a concise list of transactions that would need to be listed on Schedule 3, with the same columns required for Schedule 3:

- Year of acquisition

- Proceeds of disposition

- Adjusted cost base

- Outlays and expenses

- Gain (or loss)

Great improvements! Been using this site for free for years and when I saw what the Premium version included I signed right up! Been looking for an easy/cheap way of doing the ACB calculations and this is certainly the most cost-effective way!

Keep up the awesome work!

Sean,

I’m very happy to hear that! Thank you for your feedback.

Doesn’t seem to work for 2015. I’ve got a few eligible transactions in my portfolio for 2015 but it’s not generating a pdf. It worked for 2014. A bit odd.

I figured it out–my mistake. I was entering the buy and sell as total dollars and not as price per share — and I left off the shares. So I guess it couldn’t calculate the capital gains.

Great service, by the way! I didn’t think twice before signing up for the premium. So much easier than the alternative of trying scrape online ETF reports and brokerage reports.

Herb,

I’m glad to hear you figured it out, and thanks for the feedback!

There’s now an error message if you enter a sell transaction with zero shares. Hopefully this will mitigate any similar mistakes and confusion in the future.

Thank you for this wonderful site.

I just wanted to comment on how incredible the author is at responding to feedback.

I made the suggestion of allowing a user-determined tax year end, for those who need data in this form.

And within minutes, the feature was added and functional!

Much appreciated. Keep up the great work on this site. Subscribing to premium is a no-brainer.

Thank you Neil!

Hi there,

I agree with all of the above comments praising this site. I am seriously considering subscribing to he Premium version but have one question re funds in U.S. dollars. Does the Premium version do all of the buy/sell calculations of U.S. dollars to Can. dollars which is required by Canadian Revenue for Income Tax ;purposes when calculating Capital Gains?

Maurice,

AdjustedCostBase.ca does support inputting transactions in a foreign currency (this features is available to both Premium and Basic accounts). For further information, please see:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/

Have used your service for a few years now and it has helped with tracking my options trades.

Question: The Capital Gains Report shows a negative Proceeds of Disposition (2) for one security, but the Schedule 3 in Turbotax refuses to accept a negative value in this field. Is this an error on my part? This situation resulted from a trade where I Sold to Open an option on a security in 2016 and in 2017 I Bought to Close that security at a loss which resulted in the negative proceeds value. I would appreciate any help you can provide in correctly entering this loss in my tax return

Mark,

Schedule 3 is not designed well to handle all circumstances, such as options trades. For cases such as when options are sold to close, the proceeds of disposition are shown as a negative value. If your software does not support inputting a negative value for the proceeds of disposition then I would suggest moving this value to the outlays and expenses column, as a positive value. If you have a commission in this column then the new value should be equal to the commission plus the absolute value of the negative amount in the outlays and expenses column. The most important thing is to ensure that the gain or loss is correct.

Hi,

I currently use TurboTax for filing my tax. What do you do once you download this PDF? Do you somehow import it into TurboTax and it auto populates onto my Schedule 3? Not too sure what do once I download this PDF.

Charles,

In TurboTax you can input capital gains by going to the “Your Taxes” menu option, then searching for “capital gains” and selecting the “S3: Capital gains (or losses)” item. For each disposition, add one of these items. The columns in the annual capital gains report closely correspond to the input fields, so populate these fields accordingly.

Thanks for the quick response. Ya I was able to find this section. What I wanted to know is there a way to import the values? Or do you have to manually input each values.

Charles,

You will have to add the capital gains manually. However, if you lump them all together as a single capital gain entry using the totals for each column you should obtain the same result.

Hi,

The report lists options with the same underlying but different strikes as different dispositions. Can I lump them together by the underlying security? Or do I have to enter it line by line as shown in the report?

Thanks.

Justin,

I don’t know of any documentation published by the CRA specifying any strict requirements on how dispositions should be inputted into Schedule 3. It would seem that each disposition should be inputted on a separate line, however, so I would suggest splitting up sales involving distinct options.

Hi,

I own some warrants that I plan to exercise this year. How do I input this into my portfolio on your website and how will this be displayed on Schedule 3 come tax time next year. I am planning to subscribe to premium later this year.

Cheers,

Alden

Alden,

The exercise of the warrants can be inputted as a buy transaction with a total amount equal to the sum of the following:

– The amount paid to exercise the warrants and purchase the new shares

– The taxable benefit corresponding to the value of the warrants received, if any

There would be nothing to report on your tax return until the underlying shares are sold.

Hi!

The issue I am experiencing is that I purchased warrants of a publicly traded company on the open market several times this year to DCA. As the warrants were expiring in July I decided to exercise them as they were in the money.

Now as I already input warrant’s as a “buy” on your website I am not sure how to convert them to shares with new ACB (price of warrant + exercise price). I cannot classify them as a sell as that could trigger a capital gain or loss in the year end report and I cannot delete the warrant transactions and input as new shares purchase as I am using your website to keep track of my transactions. I feel that there should be an option “Exercise of Warrants” which would allow you to convert warrants into shares with new ACB.

Cheers,

Alden

Alden,

To clarify, you can input a “Buy” transaction for the underlying shares to represent the purchase of the underlying shares at the time of exercise. The cost of purchasing the warrants can be manually added to the exercise price and you would not need to add another “Buy” transaction for the purchase of the warrants.

Alternatively, you can add a “Buy Call Options (to Open)” transaction for the underlying shares with the status set to “Closed (Options Exercised)”. For further details see Example 3 here:

https://www.adjustedcostbase.ca/blog/adjusted-cost-base-and-capital-gains-for-stock-options/

Hello!

I did as you first suggested, but now it shows that I have negative shares with a note that the transaction appears to involve a short sale. Not sure how to proceed …

Alden,

Can you please provide the further details on the set of transactions you used?

Hi,

I began trading credit spread options last year and have been using this site to track all the transactions. I just received a bunch of T5008 slips from TD and now I am confused on how to input all this information in conjunction to using the capital gains PDF report in Turbotax Online. Any advice would be helpful! Thank you!

Matt,

The figures reported on your T5008 slips may be accurate or incomplete (see https://www.adjustedcostbase.ca/blog/can-you-rely-on-your-brokerage-for-calculating-adjusted-cost-base-and-capital-gains/), so I wouldn’t suggest relying on them for completing your taxes. However, you may want to refer to them for the purposes of sanity checking and ensuring you’ve accounted for all your dispositions.

Please see the comment above about TurboTax:

https://www.adjustedcostbase.ca/blog/annual-capital-gains-pdf-reports/#comment-157083

as well as the following comment, which may be relevant for your options transactions:

https://www.adjustedcostbase.ca/blog/annual-capital-gains-pdf-reports/#comment-156985

Can you confirm,please? There is no direct method to migrate the PDF info to the 5008 Cap Gains and Losses Return in Wealthsimple Simple Tax . I was almost sure it worked in 2021 very well but don’t see any means of doing so in 2022. Hoping to heavens I am just missing something in the technique. Please advise as it will entail a lot of manual input otherwise!

With thanks, Ron

Ron,

I would suggest inputting capital gains and losses using the “Capital Gains (or Losses)” section on Wealthsimple Tax, rather than using T5008 slips. The former uses a format that is very similar to the annual reports generated by AdjustedCostBase.ca, and also similar to Schedule 3. Each line in the report can be transferred to a corresponding line in the “Capital Gains (or Losses)” section, by copying the “proceeds of disposition”, “adjusted cost base” and “outlays and expenses” values. If you prefer, you can input the consolidated values (summed across all dispositions for the year) as a single entry.

Hi, I’ve started utilizing this site for entering my transactions on my non-registered investment account. Works great! I would like to verify though that I, theoratically, would only need the PDF ACB report if I sell shares so as to report any gains/losses on my tax report, right? Thank you.

Patrick,

If you haven’t sold any shares during a tax year, then the Annual Capital Gains Report may not contain useful information. The main purpose is to assist you with inputting dispositions into Schedule 3, but if there were no sales then this will not be necessary. Other parts of Schedule 3 may need to be populated, such as capital gains originating from T-slips, but this is normally handled automatically by tax software.

Another use of the Annual Capital Gains Report is to assist with completing Form T1135 (the Foreign Income Verification Statement). This is required when you have specified foreign property costing more than $100,000, and this requirement does not depend on whether you’ve sold shares. This form requires you to include the “maximum cost amount during the year” for shares. These values appear on the Annual Capital Gains Report when you enable the “Include Closing and Maximum ACB Balances” option.

On the Capital Gains Report, what are “Period 1” and “Period 2” in Notes? I don’t recall ever seeing this on the report in prior years.

Thanks!

Dale,

For 2024 only, the CRA’s forms split out capital gains into 2 periods:

– Period 1 (January 1, 2024 to June 24, 2024)

– Period 2 (June 25, 2024 to December 31, 2024)

As a result, your tax software will likely enable you to apply each capital gain/loss to either Period 1 or Period 2.

Note that the impact of placing a capital gain/loss in one period or the other should have no net impact on your tax return. On January 31, 2025 it was announced that the increase to the capital gains inclusion rate is deferred until January 1, 2026 (and may never see the light of day). So the same inclusion rate applies to both periods, but the CRA has retained some aspects of the updated forms (originally designed to handle multiple inclusion rates during 2024).

Annual reports on AdjustedCostBase.ca will note whether each gain corresponds to Period 1 or Period 2. This is effective for reports generated that cover a period having at least one day in 2024.

Thank you so much!

Hello ACB Support,

RE: the comment above, “If your software does not support inputting a negative value for the proceeds of disposition then I would suggest moving this value to the outlays and expenses column, as a positive value. If you have a commission in this column then the new value should be equal to the commission plus the absolute value of the negative amount in the outlays and expenses column. The most important thing is to ensure that the gain or loss is correct.”

I’m having trouble understanding this and wondered if you could clarify with the following example from one entry in my Capital Gains (or Loses) statement: (2) ($13.32), (3) $0.00, (4) $1.33, (5) ($14.65)

Thank you!

Jeremy,

If your tax software does not permit you to input a negative number in column 2, then for your example you can set column 2 to $0, set column 3 to $13.32 and leave column 4 as $1.33. This should give you the same loss amount of ($14.65).

Thank you so much for clarifying! I use Turbotax and it doesn’t allow for negative numbers. Thank you for AdjustedCostBase.ca Premium, it makes tax time so much easier!